Launched in mid-June, the ONE+Boston mortgage program aims to elevate the ONE program to address modern Bostonians. Here’s what that means for you.

Whether you’re a potential homeowner, or a real estate agent, Mayor Walsh’s goal of adding 1,000 new Boston homeowners over the next three years is certainly welcome news. Of course, wanting something to happen, and making it happen are two entirely different beasts: which is why this program is such an exciting announcement for Bostonians.

The new ONE+Boston mortgage program is aimed at increasing purchasing power for first-time home buyers in Boston. So how does it stack up? Does it meet its lofty goal, or is it another case of good intentions with little practical impact?

Let’s take a look.

What Is the ONE+Boston Mortgage Program?

For starters, it’s a continuation of the successful ONE Mortgage program, aimed at making it easier for first-time purchasers to make the dream of home ownership a reality. More than 22,000 low and moderate income families have purchased their first home all across Massachusetts thanks to the program, and it’s still running strong today.

But as anyone who lives in the hub can tell you, real estate prices in Boston are a whole other ballgame. And while the ONE program can certainly help to soften that blow, it’s still not enough to close the gap for many Bostonians.

ONE+Boston aims to change that. Not only by making home ownership more accessible, but also increasing recipients’ purchasing power to scale with Boston’s higher housing costs, subsidized by the City of Boston’s existing funds.

What Are the Differences?

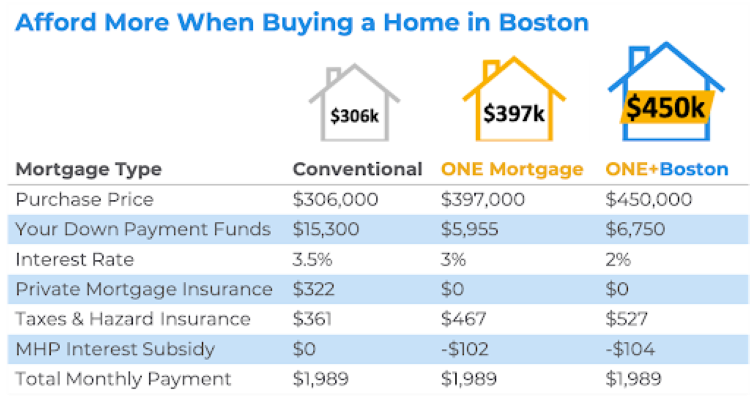

One of the big changes is helping recipients afford more house for their money. As shown in the above graphic, ONE+Boston recipients can afford properties costing as much as $144,000 more than a conventional loan for the same total monthly payment — and with less than half the down payment. Additionally, they sport an even better interest rate than the already-impressive ONE Mortgage.

Of course, to take part in the ONE+Boston mortgage program, you have to be a current Boston resident. If you’re looking to move to the city, you’re out of luck: ONE+Boston is designed to alleviate Boston residents’ difficulties in acquiring their first homes, where the existing ONE Mortgage doesn’t quite bridge the gap.

In short, ONE+Boston provides qualified participants with the following:

- Significantly discounted, fixed 30-year interest rates

- Even greater down-payment assistance via the City of Boston

- No private mortgage insurance (PMI)

- Additional financial assistance for eligible buyers

While the ONE Mortgage also offers lower, fixed interest rates, does away with PMI, and offers eligible buyers financial assistance, the ONE+Boston program goes farther, as it has more ground to cover.

Who is ONE+Boston For?

In short? Any Boston resident who dreams of owning their own home, but struggles to make that dream a reality. Prior to its launch, Boston Magazine noted that millennials could “have (their) avocado toast and eat it too,” which is surely good news for a generation that’s disproportionately unlikely to own their own home,and feels overwhelmed by the process.

Organizations like the Greater Boston Interfaith Organization, Massachusetts Affordable Housing Alliance, Massachusetts Housing Partnership (MHP), and Barriers to Home-ownership Working Group (who assisted in the creation of the program) are involved with the program, aiming to provide assistance for families of color, low to middle-income families, and all other first-time home buyers. Everyone is welcome.

Bottom line, anyone who lives in Boston, but has difficulty acquiring a home there, owes it to themselves to take a look at the program.

What Do Applicants Need to Qualify?

As stated previously, applicants must be first-time home buyers — which, for legal purposes, means that they have not owned a home at any time in the past three years — as well as currently residing in the City of Boston. Applicants are also required to take a home buyer class — which you can find here — to help prepare them for the process of buying and owning a home.

Past that, buyers will need to provide the minimum down payments required: which, while exponentially lower than in the unassisted process, can still be significant sums. The program requires a 3% down payment for single-family homes, two-family homes, and condos, and a 5% down-payment for a three-family home.

There are also a couple of financial requirements that must be met. The household needs to:

- Have less than $75,000 in household assets — things like checking accounts and stocks, but excluding retirement and college savings accounts.

- Have a credit score of 640 or higher for condos and single family homes, and 660+ for two and three family homes. Additionally, the ONE+Boston Mortgage Program has options in place for applicants with no credit history.

- Have a total household income under the following limits:

1 adult — $83,300

2 adults — $95,200

3 adults — $107,100

4 adults — $119,000

5 adults — $128,520

6 adults — $138,040

7 & 8 adults — $147,560

I Think I Qualify For ONE+Boston: What Do I Do Now?

The ONE+Boston website has more information on this, as well as a list of approved lenders. If you’ve already got a property in mind, your next step will be finding a home buyer class. And if you’re not sure where to start, take a look through our homes or condos for sale. Or reach out to us — we can help walk you through every step of the process.

What Should Realtors Know About ONE+Boston?

Whether you’re trying to sell a particular property, or help buyers find the perfect home for them, as a realtor it’s vital that you understand the resources available Many would-be home buyers never consider it, because they assume that they’ll never be able to afford a home in Boston… so why get their hopes up?

If you’re in Boston real estate, you really owe it to your clients — to learn the ins and outs of this program. This program is an easy way from taking a renter to a homeowner, improving their financial life significantly by investing in the right product.

A Bright Horizon

With everything going on in the world, it’s nice to get some unambiguously good news. And ONE+Boston absolutely qualifies. So whether you’re a renter who’s given up on ever owning a home (or ever owning one again), looking for your first home, or a real estate broker or agent working hard for your clients, ONE+ Boston is a welcome breath of fresh air.

Demetrios Salpoglou

Published July 6, 2020

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.