The city of Boston has experienced record housing market growth over the past decade. Median sale prices have soared on account of a tight supply of for-sale properties and growing demand. In 2011, the median sale price for a single-family home in Boston was $375,000. Just 11 years later, that figure has more than doubled to $812,000. With such rapid price growth, you may be wondering if Boston is still a good place to purchase a home that will appreciate in value long-term?

Boston is still a good place to buy real estate because the city’s long-term economic outlook is positive. Despite the current economic slump we’re experiencing, there are many reasons to believe that they are only temporary and Boston’s housing market will recover. Here are a few reasons why:

1. The supply problem is not going away

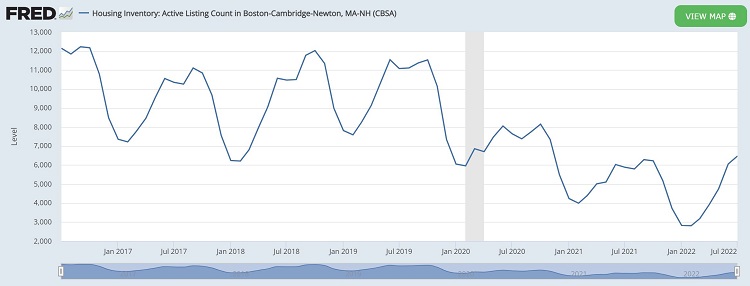

One of the main reasons Boston’s median price has risen so much is because of the limited supply of for sale inventory in the metro region. Boston is a very old city and has been undergoing development for the better part of 500 years. There just isn’t enough developable land to meet rising demand for housing. The city has been scrambling to green light large multi-unit condo developments to combat soaring real estate prices, but we’re still falling short. Boston’s total supply of for sale properties has steadily declined over the past 5 years despite the city’s efforts to create new inventory. That problem is not likely to be resolved anytime soon.

2. Long-Term Housing Demand Looks Positive

In spite of the recession either in front of us or already here, Boston is still adding jobs at a higher margin than the national average. According to the Bureau of Labor & Statistics, Boston saw a 6.4% increase in professional service jobs compared to a 5.7% gain nationally. That’s no surprise to those who know that Boston has ranked #3 on the list of cities attracting the most VC funding over the past 5 years. This trend is unlikely to change, as Boston provides tech startups a local recruiting pool unlike any other: Harvard, MIT, BU, NU, and more.

3. Recessions are temporary and we’ll likely bounce back faster than we did in 2008

In 2008, home prices dropped by a record -8.5% in 2011. It took a full 3 and a half years for prices to recover to pre-recession levels. We don’t believe that will be the case this time around, at least not in Boston. With all the money flowing to healthcare and biotech following the pandemic, it’s reasonable to expect that Boston will continue to attract more economic opportunity and high-salaried white collar workers. This will put additional demand pressure on an already tight supply of homes for sale in Boston.

Why is Boston real estate so expensive?

The reason Boston real estate is so expensive is simply because the supply of properties for sale has not been able to keep up with the rising demand for housing. As the local economy has grown over the past 20 years, Boston has transformed itself from the blue-collar city of the twentieth century to a white collar tech hub in the new millennium. This new demographic has more income and higher standards of living. That’s why Boston’s skyline has transformed to a luxury high rise haven since 2000. Combine that with the tight supply of properties, it’s a recipe for price growth.

How much is the average house in Boston?

The 1-year median sale price for single family homes in Boston is $816,353 as of 8/1. That figure is up 4.46% since January 1 and +8.13% compared to September 2021. The median price for single family homes can vary greatly by neighborhood. The following chart shows the median sale price for the 24 neighborhoods closest to Boston that have recorded single-family home sales in the last year:

| Area | Single Fam Med Price Aug 2022 |

| All Boston | $816,353 |

| Back Bay | $5,821,429 |

| South End | $4,153,261 |

| Beacon Hill | $3,722,656 |

| Brookline | $2,735,813 |

| Cambridge | $2,026,928 |

| Bay Village | $1,780,000 |

| Newton | $1,765,918 |

| Charlestown | $1,447,057 |

| Jamaica Plain | $1,158,944 |

| Mission Hill | $1,100,000 |

| South Boston | $1,076,636 |

| Somerville | $1,057,601 |

| Roslindale | $822,608 |

| Brighton | $815,000 |

| Medford | $789,022 |

| Dorchester | $745,835 |

| East Boston | $699,480 |

| Quincy | $649,188 |

| Roxbury | $637,647 |

| Hyde Park | $618,926 |

| Fort Hill | $600,000 |

| Chelsea | $597,082 |

| Mattapan | $524,971 |

How much does a condo cost in Boston?

The 1-year median sale price for condos in Boston is $730,242. That figure has risen by 4.32% since January and +7.39% since last September. Condos typically are priced better in Boston on account of a much higher supply. Condo sales have exceeded those of single-family homes five-fold in recent years. The following table ranks the 33 neighborhoods closest to Boston in terms of 1-year median condo sale price.

| Area | Condo Med Price Aug 2022 |

| All Boston | $730,242 |

| Back Bay | $1,825,695 |

| Seaport | $1,715,520 |

| Downtown | $1,660,667 |

| Bay Village | $1,555,412 |

| Beacon Hill | $1,357,987 |

| South End | $1,273,155 |

| Brookline | $1,038,575 |

| Cambridge | $1,011,289 |

| Newton | $960,875 |

| Leather District | $951,722 |

| North End | $858,769 |

| Somerville | $856,350 |

| Charlestown | $845,113 |

| South Boston | $834,490 |

| Longwood | $804,305 |

| Chinatown | $730,000 |

| Lower Allston | $722,250 |

| Jamaica Plain | $694,832 |

| Fort Hill | $660,000 |

| Medford | $653,961 |

| East Boston | $626,847 |

| Fenway | $617,685 |

| Roslindale | $582,919 |

| Mattapan | $575,000 |

| Dorchester | $546,853 |

| Mission Hill | $544,149 |

| Roxbury | $541,008 |

| Brighton | $525,024 |

Conclusion

In conclusion, Boston is still a good city to purchase real estate despite the rapid price growth over the past decade and the looming recession. To say Boston’s housing market is in a bubble is to ignore the fact that Boston has transformed itself over the past 20 years. With economic expansion comes rising home prices, and we’re confident that economic growth will continue in Boston well beyond the current recession. For that reason, buying real estate in Boston is still a good long-term bet.

Anthony Tse

Published August 30, 2022