As economic conditions have worsened throughout 2022, many are wondering if prices for Boston real estate have begun to trend downwards. To combat inflation, the Fed has increased interest rates 4 times thus far in 2022. Based on their July meeting, more rate hikes are likely ahead of us. If you analyze this year’s MLS data, you can see this has already begun to erode homebuyer demand, but are home prices falling in Boston as well?

The answer is no (not yet). Real estate prices have not come down in Boston’s real estate market thus far in 2022. MLS data shows that homebuyer demand has waned in 2022, but real estate prices have yet to come down in the city. As it stands, the 1-year median price of single-family homes for sale in Boston is $816,353. That median price is up +4.46% since January and up +8.13% since September 2021. Similarly, the 1-year median sale price for Boston condos is $730,232, which is up +4.32% since January and +7.39% since last September. So while real estate prices have risen in 2022, they have increased at lower margins than last year, indicating a cooling housing market.

| Boston | Jul 2022 | Jan 2022 | % Change | Sep 2021 | % Change |

| 1 Yr. Median Sale Price (Single family) | $816,353 | $781,474 | 4.46% | $755,000 | +8.13% |

| 1 Yr. Median Sale Price (Condo) | $730,242 | $699,989 | 4.32% | $680,000 | +7.39% |

Will Housing Prices Fall in 2022 Boston?

Based on the current MLS data, it does not look like Boston’s 1-year median price change percentage will hit red numbers before the end of the year. We do forecast that prices will begin to trend downwards in the final quarter of 2022, but not enough to fall below Boston’s 2021 median sale price for single-family homes ($781,474) or condos ($699,989).

As of August 1, Boston has recorded 7,260 residential real estate transactions over the past year. That figure is down -6.36% compared to January 1. Similarly, the total inventory of real estate properties in Boston has more than doubled over that time span, with 1,557 properties for sale on August 1, 2022 compared to just 716 on January 1. Fewer property sales and large increases in for-sale inventory both illustrate that demand for homes is dropping. This is why Boston’s median home price growth is decelerating now and could dip by 5% or more next year depending on the severity of the recession.

| Boston | Jul 2022 | Jan 2022 | % Change | Sep 2021 | % Change |

| Current Inventory | 1,557 | 716 | 117.46% | 1,113 | +44.20% |

| 1 Year Property Sales | 7,260 | 7,753 | -6.36% | 7,397 | -1.85% |

Based on this data and current economic conditions, we do forecast that Boston real estate prices will begin to trend downwards in the next few months. As interest rates rise, more homebuyers are pushed out of the real estate market, adversely impacting demand. Also, as inflation runs rampant, consumer purchasing power declines, which will also tamper with housing demand. We’re already seeing that occur in Boston’s real estate market. We must also consider the prospect of corporate layoffs, which are typical during recession periods, and the destructive impact they have on demand.

Is Boston Real Estate Overpriced?

Boston real estate is not overpriced because of the simple fact that median household income has increased in Boston alongside median home prices. According to data from the US Census Bureau, metro Boston’s median household income has increased by +31.38% from 2011 to 2020.

| City | 2020 | 2011 | % Change |

| Boston-Cambridge-Newton, MA | $94,430 | $71,878 | +31.38% |

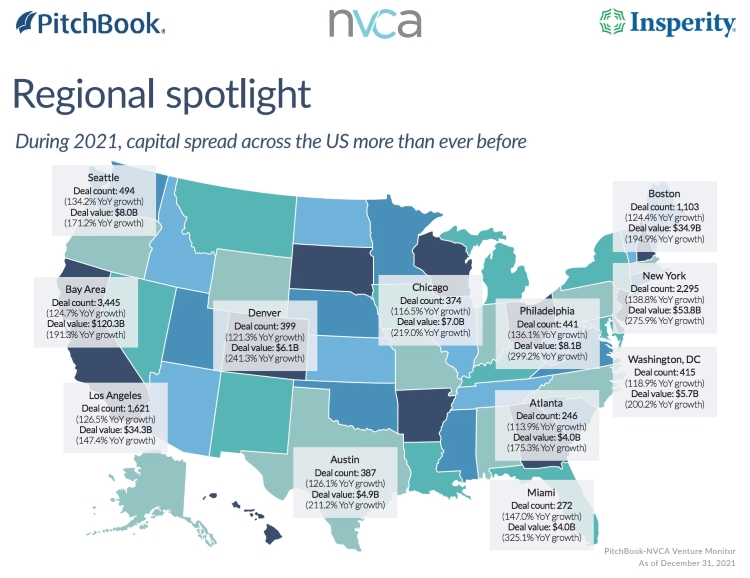

This has been due in large part to Boston’s ability to attract startup companies, which has added thousands of new high salaried jobs to the metro area. Boston has emerged as one of the biotech capitals of the world in recent years as VC funding has increasingly flowed into Boston. Over the past decade, Boston has become the 3rd largest US market for total VC funding behind New York and San Francisco according to Pitchbook’s Venture Monitor.

That is one of the primary reasons why Boston real estate prices are nearing New York and San Francisco levels. This trend is unlikely to change, as Boston has arguably the greatest recruiting pools in the world (think Harvard, MIT, Northeastern, etc.). For these reasons, we do not feel like real estate is overvalued in Boston.

Is Massachusetts in a Housing Bubble?

At this point, Massachusetts does not appear to be in a housing bubble. A housing bubble is defined as a period of unsustainable home price growth which is usually followed by a sustained period of devaluation. To call the home price growth in Massachusetts unsustainable would be inaccurate.

Between the influx of VC funding, the growing metro population, and income growth, there’s still many reasons to be bullish on the Greater Boston housing market. While it’s true that Western Mass is losing residents, the median sale price in Springfield, MA is still at a reasonable $270,000. The Boston metro will continue to add jobs in the medical and biotech spaces, attracting with them more high income white-collar professionals with purchasing power. Boston’s long-term housing outlook appears optimistic beyond the recession.

Conclusion

In conclusion, our long term outlook for Boston’s real estate market is positive. However in the short term, price corrections do appear to be imminent. During the 2008 housing bubble, home prices fell by -8.5% nationwide and took about three and a half years to recover. We do not expect Boston real estate prices to drop more than -8.5% in 2023. A more likely figure will be in the 5% range. Unless mass corporate layoffs become the norm, expect for home prices to rebound more quickly than they did in 2008 due to new jobs being added in the metro region. We will continue to cover these Boston housing market trends as they develop. For all things Boston real estate, check out Boston Pads!

Demetrios Salpoglou

Published September 6, 2022

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.