This year has brought with it some economic uncertainty that will inevitably affect the local housing economy. Last month, the year-over-year consumer price index was up by a staggering +8.3%, indicating that post-pandemic inflation concerns are far from over. The Fed has been steadily raising interest rates this year as a result. But how exactly will this affect the Boston housing market?

Inflation will affect the Boston housing market by causing home sales to drop and median sale prices to decelerate in 2022. The combination of higher interest rates and high home prices will push many buyers out of the market this year. Shortages in labor, materials, and diesel gas will push up the cost of development and property maintenance, which will help to keep home prices growing this year, but at a significantly lower margin than previous years. Rent prices in Boston will grow by a larger margin than home prices amidst a shortage of rental inventory and higher costs of maintenance for landlords.

Homes Prices Are Decelerating In Boston

Boston’s housing market remained red hot throughout most of the pandemic. Median home prices surged by double digit margins every year in Boston from 2018 through 2021 due to low interest rates, high demand, and a short supply of homes for sale in Boston. This year, we’re seeing home price growth decelerate as interest rates rise due to inflation.

The current 1-year median sale price for single family homes in Boston is $807,823. That figure is up +3.37% since its level on January 1, 2022, which is significantly lower than the +16.5% home price growth Boston recorded in 2021. The 1 year median sale price for condos and multifamily properties saw similar price deceleration, with both recording a +2.31% and +4.95% increase in price over the same time span.

Price deceleration is typical in housing markets that face inflation. As interest rates go up, so does the supply of homes for sale as more buyers are priced out of the market.

Total Housing Inventory More Than Doubled In Boston Since Start of 2022

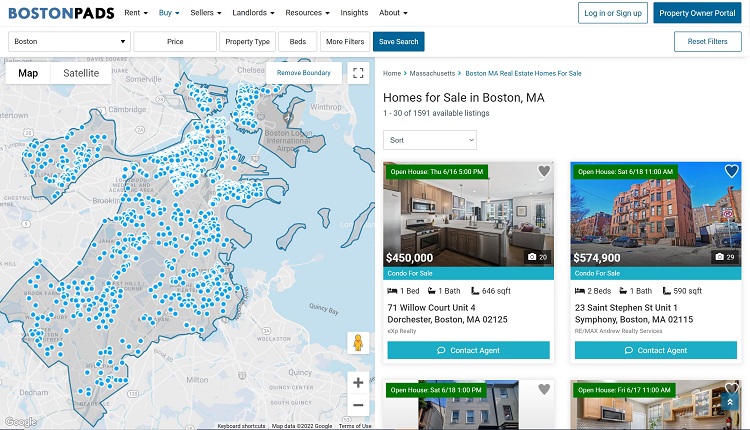

As of June 15, 2022, there were 1,600 active residential listings in MLS for sale in Boston. That marks a 123.46% increase in available inventory since January 1, when there were just 716 residential properties for sale in Boston. This surge in inventory is a product of two forces. For one, seller confidence is waning as inflation and recession looms, so more are listing their properties in an effort to cash in at the market’s peak. Two, less buyers are entering the market due to higher interest rates caused by inflation.

We’re also seeing total property sales declining in Boston over the same time period. The 1-year total sales in mid June 2022 was 7,515. That figure is down -3.07% from its level on January 1, 2022 (7,753). Look for this trend to continue in Boston in 2022, as this is typical market behavior while inflation is high.

Materials, Labor, & Diesel Gas Prices Are All On The Rise

Inflation has many direct and indirect effects on the housing market. A big reason that housing prices rise during inflation is because the cost of building and maintaining properties goes up. The consumer price index may only be up +8.3%, but the cost of diesel gas is up +76% over the past year, which has drastically inflated the cost of building materials and overall development. Nearly all construction sites utilize larger capacity/ horsepower vehicles for transport and delivery of materials; and diesel fuel is the predominant energy source.

In addition to that, labor shortages push up the cost of maintenance even more, forcing many sellers to list their properties higher to try and recoup expenses. The effects of this are not limited to the market for real estate sales. The rental market bears the costs of these price increases as well. Landlords are forced to raise rent prices as the cost of property management and maintenance increases, which is exactly what we’re seeing in Boston.

Inflation’s Effect on the Boston Apartment Rental Market

Boston’s apartment rental market is experiencing historically low apartment inventory in 2022. The real-time vacancy rate (RTVR) of apartments in Boston is currently sitting at 0.47% after breaking its all time low in late May. The current real-time availability rate (RTAR) of apartments in Boston is 3.38%, which is 37.87% lower than its pre-pandemic level in June 2019 (5.44%). That means apartment renters in Boston are seeing almost a third less inventory available than they did pre-COVID.

This record low inventory is a product of 2 forces related to inflation. For one, higher interest rates are forcing more potential home buyers out of the market for sales and into the rental market. That’s placing upward pressure on demand for apartments in Boston, which was already high to begin with. Also as previously discussed, inflation is causing the cost of property maintenance to increase for landlords. Those costs will always trickle down to the renter in the form of rent increases.

As a result, we’ve seen the average rent price in Boston surpass its previous all-time high in mid April. The current average rent price of $2,692 is up +5.96% over the past 12 months after stagnating throughout much of the pandemic. Look for this trend to continue in Boston in 2022, as we’ll likely see average rent price growth continue to outpace home price growth while inflation persists and interest rates continue to climb.

Demetrios Salpoglou

Published June 20, 2022

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.