***UPDATED*** This market report has been updated, check out our 2023 Boston Apartment Rental Market Report!

Looking back at the last two years of rental market data, it’s safe to say that few metro markets have experienced the same level of upheaval and subsequent recovery as Boston. In our 2021 Boston rental market report, we detailed an unprecedented increase in rental supply numbers that occurred as a result of COVID-19. Roughly one year later, the data suggests our Boston apartment market has not only corrected itself, but it’s possibly even stronger than it was prior to the pandemic.

Boston Apartment Supply Metrics Sink Below Pre-Pandemic Levels

Both of Boston’s key apartment supply metrics, real-time vacancy rate (RTVR) and real-time availability rate (RTAR), have sunk below pre-pandemic levels (-36.36% and -40.00% from January 2020 respectively). Comparing these same metrics to January 2021, when we were nearing the worst of the COVID-induced supply glut, we see that availability of Boston apartments has decreased by -67.20%. The vacancy rate has dropped by a staggering -86.88% in the same time span. What a difference a year makes.

This rapid rental supply contraction and market recovery began in April of 2021 when people perceived the worst days of the pandemic were behind them. Looking at the historical RTAR for Boston, you can clearly see the triple black diamond ski slope absorption curve that began in April of last year.

The late January RTAR of 2.87% and RTVR of 0.69% are both at the lowest levels we have ever recorded. Many would look at these figures as proof that the local housing market has emerged from the pandemic unscathed. Seeing supply numbers like this is certainly something to celebrate after a long two years of market uncertainty. However, if you look at search trends and traffic data, it suggests that some lingering effects of COVID are inversely impacting the apartment supply as we begin 2022.

COVID-19, Omicron, and Renter Fatigue

In 2021, we saw the unprecedented rental absorption suddenly dissipate in late fall when Omicron came to town. Restrictions tightened and mobility slowed as many feared a return to 2020. Harvard decided to go back to remote learning in January, stoking fears that other Universities might follow suit. Based on historical renter behavior and the most recent Google Trends data, it appears these fears might have put a temporary slowdown in our apartment leasing in Boston.

Historically, Boston’s apartment rental market begins to warm up in the second week of January as students return for second semester. This is usually when RTAR begins to increase at an accelerated pace, as students begin to notify landlords of their plans for next year. That was not the case this year.

Google trends illustrates that the total search volume for the keyword ‘boston apartments’ was at its lowest recorded January level in the past 6 years. The current search volume is even lower than it was a year ago when market uncertainty was at its peak. Combine that with the abnormally low availability rate for late January, it shows that both renters and landlords were hesitant to make leasing decisions with the COVID cloud still hanging around.

Now that COVID-19 cases are beginning to trend down again, we are seeing a rapid uptick in activity. Apartments are hitting the market at an accelerated pace, and from the looks of rent prices, landlords are feeling much more confident this year.

2022 Average Rent Prices in Boston

Last year was a rare renter’s market in terms of apartment pricing, as Boston saw the first decrease in average rent in over a decade. Landlords, desperate to fill vacancies, slashed prices and offered incentives at a scale we’ve never seen before. Once the market began its comeback, those incentives became increasingly rare and average rent price began to trend upwards.

Price increases have accelerated over the past few weeks as this year’s inventory has begun to emerge. Perhaps the record low apartment supply is rekindling optimism amongst Boston landlords. We’re seeing apartment prices surge for larger units. Historically speaking, larger bedroom apartments usually become available earlier than smaller bedrooms so this is a trend worth watching.

Boston’s current average rent price is $2,632, which marks a 1.41% increase year-over-year. That average is still below the 2 year pre-COVID level by -1.37%, but if you look at the trend line, it looks like that will be eclipsed in 2022.

| 1-year Avg. Rent Change | 2022 Average Rent Price | 2021 Average Rent Price | % Change |

|---|---|---|---|

| City of Boston | $2,607 | $2,586 | +0.82% |

| 2-year (pre-COVID) Avg. Rent Change | 2022 Average Rent Price | 2020 Average Rent Price | % Change |

|---|---|---|---|

| City of Boston | $2,607 | $2,656 | -1.84% |

If we breakdown this data by property size, we can see that average rent prices have dropped more for smaller rental units, while larger units have surpassed pre-pandemic levels. Average rent prices for Boston studios and 1 bedroom apartments are down -4.57% and -6.69% respectively, while 3 bedroom average rents have increased by 1.37% and 4 bedrooms are up 1.57% in comparison to January 2020.

| AVG RENT PRICE STUDIO | AVG RENT PRICE 1BR | AVG RENT PRICE 2BR | AVG RENT PRICE 3BR | AVG RENT PRICE 4BR | AVG RENT PRICE 5BR |

|---|---|---|---|---|---|

| CITY OF BOSTON | CITY OF BOSTON | CITY OF BOSTON | CITY OF BOSTON | CITY OF BOSTON | CITY OF BOSTON |

| $1,722 | $2,031 | $2,531 | $3,072 | $3,681 | $4,595 |

| -4.57% | -6.69% | -2.08% | +1.37% | +1.57% | +2.56% |

The drop in pricing for smaller units may evidence of the shift in apartment demand caused by remote work and the desire for larger spaces. Boston’s young professionals tended to gravitate towards smaller apartments. Last year there was strong demand for professionals wanting an extra bedroom so they could set up separate zoom rooms in order to continue business activity. Some employers were willing to provide salary increases so their staff could get larger housing accommodations due to downsizing their commercial workplace footprint.

Predicting Boston’s 2022 Apartment Rental Market

Looking back on the last few months of apartment data, it’s easy to be lulled into a sense of security as we head into 2022. The data certainly suggests that the worst of the pandemic related market forces are behind us. This year’s market outlook appears much more optimistic than it did last year. Our historic apartment vacancy recovery is something to celebrate. It’s a testament to the strength and resilience of the Boston’s Real Estate market.

That being said, a smart investor must stay aware of all potential threats and obstacles on the horizon. There are still plenty of unknown future variables that could effectively wipe out the recovery we’ve seen in recent months. The global pandemic might not be over. There are several political and socio-economic forces in play that may have direct implications upon Boston’s apartment rental market.

5 Potential Threats The Boston Rental Market Will Face in 2022

1. Hyper-Inflation

Recent news of the Consumer Price Index surging 7.1% year-over-year is casting a shadow on all industries, including housing. Everything from services, building materials, to diesel fuel are up by double digit margins, and multifamily construction input prices are up 20% in total. The labor shortage has only fanned the flames of inflation even more, and it looks like prices will continue to rise in 2022 as the Fed eyes rate hikes. These added costs will inevitably trickle down to the renter in 2022.

2. Remote Learning 2.0

Last year we learned that closing universities can temporarily have devastating effects on our local rental market. Up until recently, few imagined we could go back to remote learning and social distancing. However, in late December Harvard announced their plan to shut down campus for the first 3 weeks of January to combat rising COVID cases. While this factor alone will have little effect on the rental market, it does raise a cautionary flag as we look towards Fall 2022. If other Universities follow that path, we’ll undoubtedly see some delays in the renewing of leases and supply increases.

3. Migration Trends

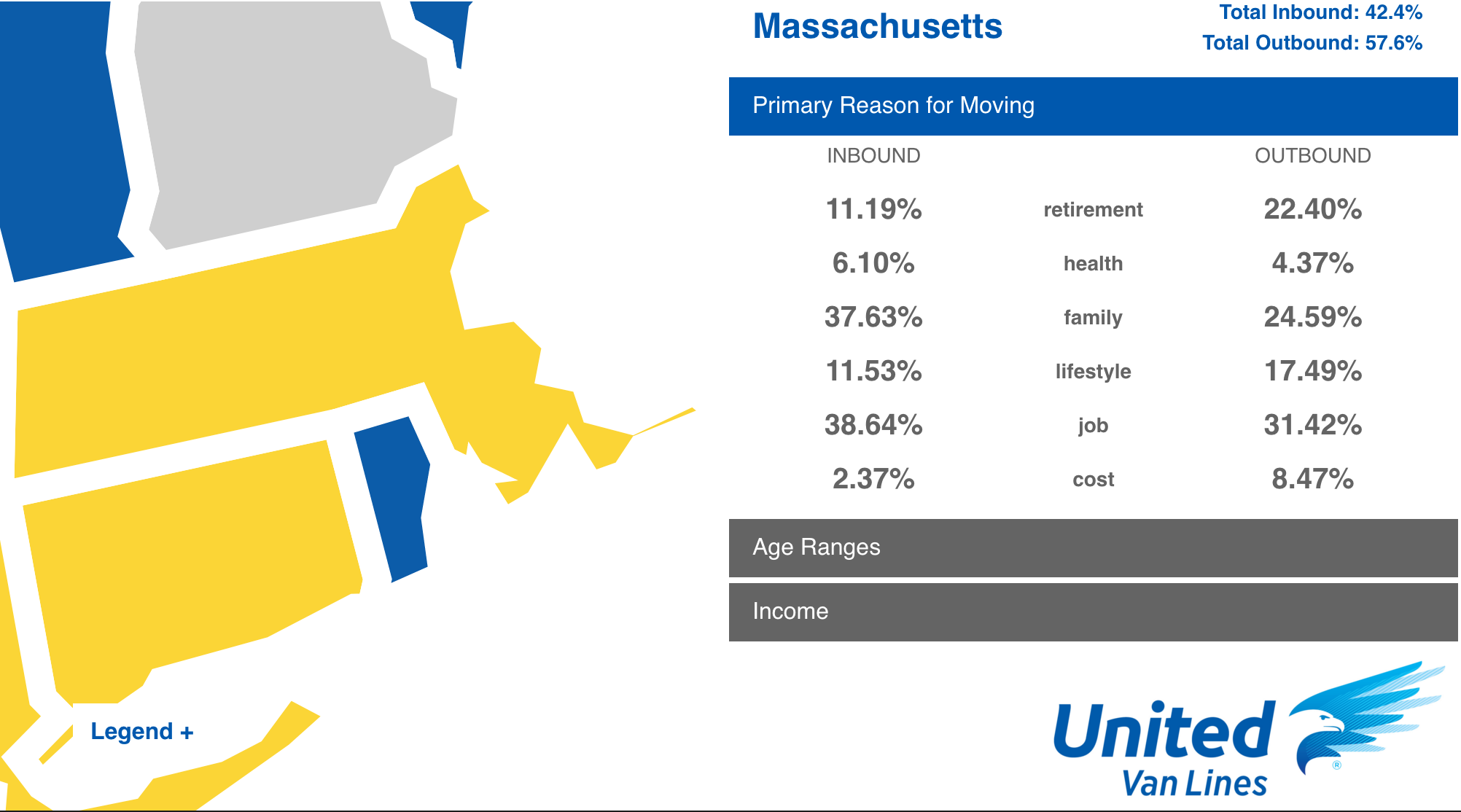

The most recent migration data reports from the US Census Bureau and largest moving companies suggest that for the first time in decades, Massachusetts has seen two consecutive years of a net loss in residents. United Van Lines ranks Massachusetts #7 for highest percentage of outbound moves in the United States. Recent US Census data also supports this trend. While this shift seems to be affecting Western Massachusetts more than the Boston Metro area, it is still a cause for concern. Rising taxes, higher assessments, labor shortages, and COVID restrictions might spur some people to move out of the Greater Boston area in favor of suburbs or southern regions with warmer economic climates.

The most recent migration data reports from the US Census Bureau and largest moving companies suggest that for the first time in decades, Massachusetts has seen two consecutive years of a net loss in residents. United Van Lines ranks Massachusetts #7 for highest percentage of outbound moves in the United States. Recent US Census data also supports this trend. While this shift seems to be affecting Western Massachusetts more than the Boston Metro area, it is still a cause for concern. Rising taxes, higher assessments, labor shortages, and COVID restrictions might spur some people to move out of the Greater Boston area in favor of suburbs or southern regions with warmer economic climates.

4. Rent Control

Last year, Mayor Wu was sworn in as Boston’s new mayor. Mayor Wu has been an advocate for rent control, the implementation of which could have devastating effects on the rental market. We’ve covered the topic in detail in previous market reports, as it is always in the conversation nearly every year in Boston. To be sure, applying rent control will do little to help the average renter in Boston. If anything, it would send rent prices higher as it has done in numerous other real estate markets across the country.

5. Unemployment Rate

The state’s unemployment rate has leveled off around 5% after spiking to an unprecedented 15.4% in May 2020. While this was obviously a result of the pandemic and the restrictions that came with it, the current unemployment rate of 5.4% still has a long way to go until it reaches the historically low unemployment rate of 2.8% we recorded in January of 2020.

6. Cooling Housing Market

After several years of double digit percentage increases in the median price for single family homes for sale in Boston, it appears as if that record growth is decelerating. Latest figures from Q4 2021 show that Boston’s single-family home prices have decreased from their summer levels and are currently up 7% YOY. That median price increase is considerably lower than the 11% growth recorded in 2020. Interest rates will likely rise throughout 2022 but still stay below 4%. This will likely push rent prices higher as investors will have to raise rents to account for higher purchase prices.

What To Expect in 2022

Barring any cataclysmic events, look for the apartment rental market to continue to strengthen over the next year. Thanks to inflation and the tight rental supply, look for prices to increase by larger margins in 2022. We’ve had numerous discussions with Boston-area landlords that are indicating their current renters are re-signing their leases in greater numbers at slightly higher rates than in previous years.

Barring any cataclysmic events, look for the apartment rental market to continue to strengthen over the next year. Thanks to inflation and the tight rental supply, look for prices to increase by larger margins in 2022. We’ve had numerous discussions with Boston-area landlords that are indicating their current renters are re-signing their leases in greater numbers at slightly higher rates than in previous years.

Renter’s may still be able to find some deals during the first few months of 2022. Prices could rise quickly. Renter’s should look to lock down an apartment early in 2022 to get the best prices. Historically speaking, Boston’s real-time rental prices tend to fall towards the end of the year due to the heavily weighted September leasing cycle. The data is suggesting that we could see an inverse trend in 2022 where prices rise throughout the entire year due to low supply and inflation.

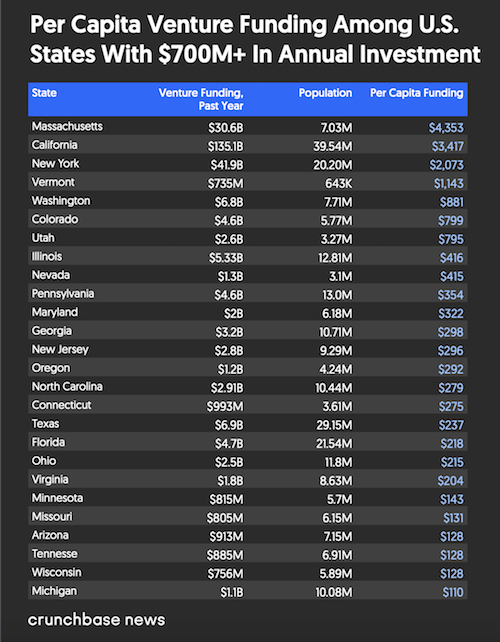

Another major factor contributing to the growth of our rental market is the steady increase of record VC funding flowing into the Boston metro area in recent years. The Boston area raised 34.9B in venture capital in 2021, a 194.9% YOY increase according to Pitchbook. In fact, Massachusetts leads the country in per capita VC funding ($4,353) according to Crunchbase. People in the tech industry want new construction, fast broadband, shared workspaces for team collaboration, and spacious work from home accommodations. Upon speaking with numerous apartment developers across the nation, they still find Boston an attractive real estate market. This is due to the growing population of high-salaried tech professionals that are willing to pay greater rents for these amenities. This helps developers offset higher new construction costs typical in the greater Boston area. Therefore, we expect to see continued growth in the development of smart apartment buildings loaded with advanced features such as: smart locks, smart appliances, automated maintenance requests, designated ride sharing locations, and electric car charging stations.

Another major factor contributing to the growth of our rental market is the steady increase of record VC funding flowing into the Boston metro area in recent years. The Boston area raised 34.9B in venture capital in 2021, a 194.9% YOY increase according to Pitchbook. In fact, Massachusetts leads the country in per capita VC funding ($4,353) according to Crunchbase. People in the tech industry want new construction, fast broadband, shared workspaces for team collaboration, and spacious work from home accommodations. Upon speaking with numerous apartment developers across the nation, they still find Boston an attractive real estate market. This is due to the growing population of high-salaried tech professionals that are willing to pay greater rents for these amenities. This helps developers offset higher new construction costs typical in the greater Boston area. Therefore, we expect to see continued growth in the development of smart apartment buildings loaded with advanced features such as: smart locks, smart appliances, automated maintenance requests, designated ride sharing locations, and electric car charging stations.

We also expect Boston’s rental market to return to its normal leasing cycle in 2022. Landlords will be less flexible with sublets and signing short term leases for unfurnished apartments. We believe we’ll see more renters re-signing leases in 2022 than we have seen in years past. Both renters and buyers are facing historically low inventory for apartments and homes for sale, which will push some to stay put this year.

Based on current data, we’re predicting average rent growth of 4-6% in Greater Boston this year. This larger than average increase in rent will primarily be attributed to an extremely tight rental supply coupled with runaway inflation. We expect demand for off campus apartment housing in Boston to remain strong in 2022.

We predict that the short-term furnished rental market will see a significant uptick in demand based on limited supply. The pandemic crushed the AirBnB and short term furnished rental market last year and caused apartment availability to swell above 25% in several of Boston’s most active rental markets. Downtown areas have since absorbed the excess apartment inventory with mostly traditional long term unfurnished one year leases. Look for shorter term furnished rental pricing to be on the rise.

We predict that the short-term furnished rental market will see a significant uptick in demand based on limited supply. The pandemic crushed the AirBnB and short term furnished rental market last year and caused apartment availability to swell above 25% in several of Boston’s most active rental markets. Downtown areas have since absorbed the excess apartment inventory with mostly traditional long term unfurnished one year leases. Look for shorter term furnished rental pricing to be on the rise.

We will continue to monitor real time housing trends in 2022. Keep an eye out for our neighborhood specific data throughout the year. It’s our goal to keep our Greater Boston community fully informed on all things real estate. We’ve also launched real-time apartment data for all of Boston’s top markets and neighborhoods for both landlords and renters. It’s never been easier to stay on top of real estate market trends in Boston. Stay tuned we have some amazing new tech coming soon!

Demetrios Salpoglou

Published February 1, 2022

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.