Investing in Boston multifamily real estate can be highly profitable—but only if you know how to analyze Boston multifamily investments effectively. With Boston’s dynamic rental market and strong property appreciation, multifamily properties can deliver significant returns. Yet, not every deal presents equal value. Here’s a structured approach to assessing multifamily investments in Boston, clearly broken down into essential components.

Evaluate the Location Carefully

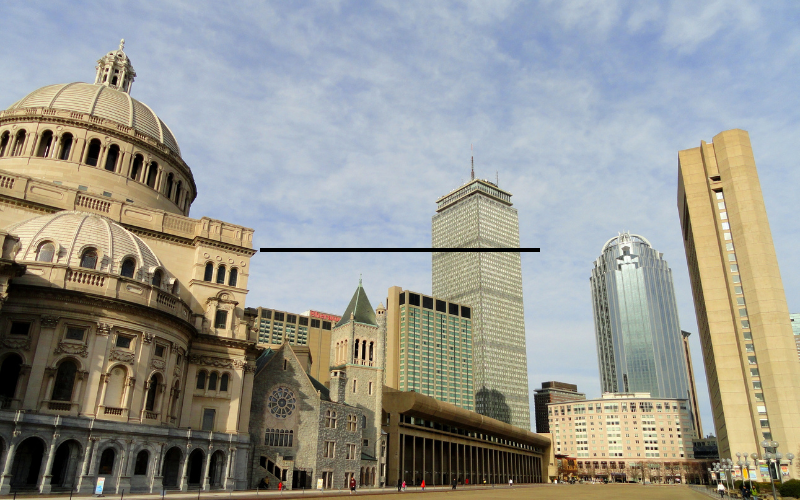

Evaluating the location of a multifamily investment in Boston is essential to ensuring profitability. The property's location significantly influences rental demand, occupancy rates, property appreciation, and overall investment returns. Precise analysis of neighborhood dynamics is a critical first step in this evaluation process. Begin by thoroughly examining the neighborhood's infrastructure. Proximity to key transportation hubs, such as subway stations, bus routes, and commuter rail services, enhances a property's desirability by offering residents convenient commuting options. Multifamily properties located near major transportation arteries typically experience higher occupancy rates and stable tenant retention due to reduced commuting times.

Consider Transportation and Education

A joint study by the American Public Transportation Association and the National Association of Realtors, as reported by WealthManagement.com, analyzed seven metropolitan areas, including Boston, and found that between 2012 and 2016, residential properties within transit-oriented districts had median sale prices that were up to 24% higher than those in areas without public transit access. The proximity of a property to educational institutions is another critical factor. Boston is renowned for its concentration of prestigious colleges and universities. Multifamily units within easy reach of these institutions attract students, faculty, and staff, generating consistent rental demand and minimizing vacancy periods. Additionally, families place high value on quality elementary and secondary schools, making these neighborhoods particularly attractive and sustaining demand from long-term tenants.

Employment and Amenities

Employment centers significantly influence tenant choice. Multifamily properties situated near Boston's key employment hubs, such as downtown, the Seaport District, Longwood Medical Area, and Kendall Square, provide greater appeal to young professionals and working adults. Short commuting distances to these areas typically translate into higher rental rates and increased tenant stability. Amenities in the immediate area greatly impact a property's marketability and rental rates. Neighborhoods with nearby grocery stores, retail shops, restaurants, cafes, and entertainment venues provide convenience and lifestyle appeal that tenants actively seek. Access to parks, walking paths, and green spaces adds further value, particularly for tenants prioritizing outdoor recreation and quality of life.

Don´t Forget to Factor in the Future

Boston’s robust population growth underscores the importance of selecting a strategic investment location. The U.S. Census Bureau reported a 9.3% increase in Boston’s population from 2010 to 2020, indicating steady and sustained demand for housing. Investing in neighborhoods with strong historical population growth trends increases the likelihood of continued appreciation and stable rental demand. Future area developments must also factor into location analysis. Planned infrastructure improvements or new commercial developments can substantially impact property values and rental potential. Research upcoming municipal projects, zoning changes, or commercial expansions that could enhance neighborhood desirability. For example, developments such as new transportation lines, hospital expansions, or major retail projects often lead to increased property values and higher rental incomes.

Analyze Market Rent and Occupancy Rates

Analyzing market rents and occupancy rates is crucial when evaluating multifamily investment opportunities in Boston. A comprehensive understanding of these factors enables investors to project potential rental income accurately and assess the property's financial viability.

Market Rent Analysis

To estimate potential rental income, it's essential to research current market rents for comparable properties in the area. The U.S. Department of Housing and Urban Development (HUD) provides Fair Market Rents (FMRs) as a benchmark for rental pricing. While specific figures can vary annually and by unit size, HUD's FMR data serves as a reliable starting point for assessing rental rates. Investors should consult the latest FMR data available on HUD's website to obtain current figures.

Additionally, our real-time Boston rental data provide exceptional insights into rental trends. For example, the average rent for Boston apartments is currently $3,316, compared to $3,023 two years ago, reflecting an increase of 9.69%. This significant increase underscores the sustained desirability of living in Boston, driven by its vibrant economy, educational institutions, and cultural amenities. Additionally, the median days on market is currently 24 days, which is 14 days fewer than it was one year ago. This growth indicates a steady upward trend in rental rates and less time apartments are unoccupied, which is essential for investors to consider when projecting future income.

Occupancy Rates

High occupancy rates typically indicate strong rental demand, providing property owners with consistent and stable cash flow. Conversely, high vacancy rates can point to potential management issues or indicate less desirable property locations. Boston's apartment market has generally maintained healthy occupancy levels, reflecting balanced market conditions and sustained tenant interest. Notably, well-maintained and stabilized properties located in appealing areas consistently achieve higher occupancy rates compared to the broader market. These properties tend to perform better due to their attractive conditions and prime locations, which appeal to tenants seeking quality housing options.

Overall, the Boston multifamily housing market demonstrates resilience, with occupancy rates remaining robust despite minor fluctuations. This stability is especially important for investors who prioritize consistent rental income and long-term investment security.

By closely examining rental trends and occupancy patterns, investors can better understand the local market dynamics, allowing for informed decisions that enhance profitability potential in the Boston area.

Cash Flow and Expenses Analysis

Conducting a thorough cash flow analysis is critical for investors evaluating multifamily investment properties in Boston. A detailed assessment involves estimating all sources of projected rental income and deducting anticipated expenses to understand a property's true profitability. Multifamily investors must consider several key expense categories to accurately assess their investment potential.

Property Taxes and Insurance

Property taxes represent a significant and recurring expense. In Boston, property tax rates directly influence operational costs for multifamily properties. For Fiscal Year 2025, Boston's residential property tax rate is $11.58 per $1,000 of assessed property value, according to the City of Boston's official assessment data. Additionally, multifamily properties may qualify for certain tax exemptions or adjustments, depending on specific criteria and usage, making it crucial for investors to confirm exact tax obligations to ensure accurate budgeting.

Insurance expenses also play an essential role in the financial assessment of multifamily investments. Adequate coverage protects against potential liabilities, property damages from events like fires or natural disasters, and loss of rental income due to unforeseen incidents. Investors should solicit quotes from multiple insurance providers to secure competitive rates while ensuring comprehensive coverage that aligns with their risk management strategies.

Utilities, Maintenance, and Repairs

Utility costs, including water, gas, electricity, and waste disposal, must be considered when analyzing potential cash flows. Multifamily properties frequently have shared utilities, meaning landlords commonly bear these expenses, particularly in older buildings without individual metering systems. Implementing energy-efficient solutions and property upgrades can help reduce these costs significantly, ultimately increasing net income.

Maintenance and repair expenses are inevitable in multifamily properties, making proactive budgeting essential. Investors must allocate funds for routine maintenance, landscaping, cleaning, common area upkeep, and general wear-and-tear repairs. Additionally, setting aside reserves for unexpected or emergency repairs is critical. A common industry practice involves budgeting 5% to 10% of gross rental income annually for ongoing maintenance and capital expenditure reserves.

Management Fees and Mortgage Payments

Management fees are another expense multifamily investors typically incur. Engaging a professional property management company can streamline operations by handling tenant relations, leasing, maintenance coordination, rent collection, and other administrative tasks. Management fees usually range from 4% to 10% of gross monthly rental income, depending on the scope of services provided and the size of the property.

Mortgage payments constitute a significant expense for multifamily investors leveraging financing. The monthly mortgage obligation, composed of principal and interest, depends on loan terms, interest rates, and borrowing amounts. Investors should carefully analyze financing options and interest rate trends to secure optimal loan terms, thereby improving overall investment returns.

Positive cash flow, achieved when rental income surpasses total expenses, indicates a healthy and viable investment opportunity. Conversely, negative cash flow, where expenses exceed income, signals potential risks or operational inefficiencies that may require adjustments. Using conservative assumptions when forecasting both income and expenses ensures that investors are better prepared for market fluctuations or unforeseen costs, ultimately safeguarding the long-term profitability of multifamily properties.

Consider the Cap Rate

The capitalization rate, commonly referred to as the cap rate, is an essential financial metric used by investors to evaluate the profitability and associated risks of multifamily investment properties in Boston. It is calculated by dividing a property's net operating income (NOI) by its purchase price or current market value. This formula offers investors a quick method to assess potential returns without involving financing costs, providing a standardized way to compare different properties.

What is a Typical Cap Rate?

Cap rates reflect investor expectations and market dynamics, offering insights into how the market perceives the risk and return profile of a given property. Typically, multifamily cap rates in Boston fall within a range that varies based on the property's location, condition, and tenant profile. Multifamily cap rates in Boston appear to widespread at approximately 6% according to numerous local real estate brokers specializing in Multifamily. This figure serves as a general benchmark to gauge the relative attractiveness of potential investments within the local market. That being said, different neighborhoods not far from each other can yield slightly higher or lower cap rates. It is not uncommon to see 5-7% cap rates if you look throughout Greater Boston. Should you decide to venture further out of Greater Boston it is not uncommon to find 8 caps. Again condition of the property and location play a huge role.

Lower Cap Rates vs. Higher Cap Rates

Generally, lower cap rates indicate lower investment risk, suggesting properties in desirable locations with strong rental demand, stable tenants, and minimal deferred maintenance. Properties with lower cap rates typically generate consistent income, providing investors with predictable returns, albeit at the cost of paying higher prices relative to the income generated. Conversely, higher cap rates typically imply greater investment risk. Such properties may be in less favorable locations, exhibit significant deferred maintenance, or have higher tenant turnover rates. While these properties might offer potential upside, investors must account for the increased volatility and potential for unexpected costs.

Investors evaluating multifamily properties must compare their targeted cap rate against market standards to ensure alignment with current investment trends and risks. Cap rate expectations should reflect the specific characteristics of the property under consideration. Investors must conduct comprehensive due diligence, including assessing the property's condition, tenant stability, and market location, to accurately determine whether the stated cap rate adequately compensates for the risk involved.

Initial vs. Stabilized Cap Rates

Furthermore, it's crucial for investors to differentiate between initial or "going-in" cap rates and stabilized or projected cap rates. The initial cap rate is based on existing net operating income at the time of purchase, while the stabilized cap rate accounts for future improvements, rent adjustments, or operational changes that investors plan to implement. This distinction helps investors project future returns and understand how initial decisions and improvements might influence overall profitability.

Cap rates can also fluctuate based on broader economic factors, including interest rate changes, market conditions, and macroeconomic trends. Monitoring these external factors helps investors adapt investment strategies, ensuring decisions remain aligned with evolving market conditions. By carefully evaluating cap rates in the context of market standards and individual property characteristics, multifamily investors in Boston can make informed decisions that align with their investment goals and accurately reflect the associated risk and potential returns.

Conclusion

In conclusion, investing in Boston multifamily real estate can offer substantial returns—but success hinges on meticulous analysis and informed decision-making. By carefully evaluating location, thoroughly analyzing market rents and occupancy rates, accurately forecasting cash flows and expenses, and strategically assessing cap rates, investors can confidently distinguish between promising opportunities and potential pitfalls. Boston’s dynamic real estate market, characterized by steady population growth, robust rental demand, and strong property appreciation, presents investors with an appealing but competitive landscape. To thrive, investors must consistently remain attentive to neighborhood developments, economic indicators, and market trends, proactively adapting their strategies to capitalize on opportunities and mitigate risks. Armed with detailed knowledge, thorough due diligence, and a clear understanding of their investment objectives, investors are positioned to secure profitable multifamily assets that deliver both immediate income and long-term appreciation. Ultimately, the disciplined and systematic approach outlined here serves as a blueprint to ensure sustainable growth, financial stability, and ongoing success in Boston's vibrant multifamily real estate market.

Kristian Kotov

Published April 25, 2025