Purchasing a new home can be an incredibly exciting time in your life, especially if you are a first-time home buyer. The prospect of owning your own house and being able to do whatever you want with it can be one of the best feelings in the world. For example, if you want to paint your walls a particular color, go for it. You certainly don’t need the permission of a landlord when you are a homeowner. Those days are over. You will be in control. If you want to plant a tree in the backyard, it’s your right to do so. The bottom line is that there are many benefits to owning Boston real estate.

In This Article...

That being said, you don’t want to box yourself into thinking that you should only purchase a single-family home or a Boston condo. This is a mistake that the vast majority of first-time home buyers make. My suggestion here is that if you can skip buying a single-family home first and instead purchase a multi-family property – you will be a lot happier in the long run. Here is why.

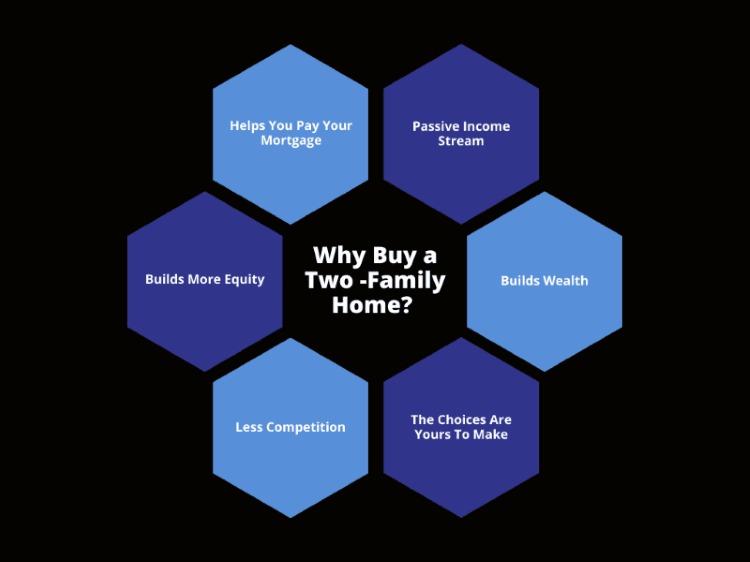

Buying a multifamily home has numerous advantages over a single-family home.

You can significantly reduce the amount of money that you spend out of pocket for your monthly mortgage payment. It will also go a long way in helping you build your real estate holdings. You may want to move out at some point and collect rent from both units. That could put you in a great position of positive cash flow that allows you to buy a bigger property in the future. That is why you should give some serious consideration to purchasing a two-family home instead of a single-family home or condominium. Most first-time home buyers are unaware of the fact that owning rental property is the absolute best method of obtaining true wealth, and purchasing a two-family property will put you on the fast track to building a valuable real estate investment portfolio. So why be like every other first-time homebuyer out there and settle for less when you can get far more for your money?

Helps You Pay Your Mortgage

When you purchase a two- family home instead of a single-family home or condo, you can live in one unit and rent out the other. That means you will have a steady stream of rental income coming in each month. In essence, you can use that rental income to help pay the monthly mortgage payments, which of course helps to offset the expense of owning your own home. For example, if your mortgage payment is $4,500 per month including taxes and homeowner’s insurance and your tenant is paying you $2,500 per month for rent, then you are only paying $2,000 per month out of pocket instead of $4,500 per month. That is a significant difference to say the least.

You do need to keep in mind that the purchase price of a two- family home may be a bit higher than that of a single-family home or condo, which means your mortgage amount and monthly payment may be a bit higher as well. However, it also means that your property is valued higher. In some instances, a savvy purchase and a quick remodel can often cover most if not all of the entire mortgage. It is important that you open up your mind to the possibilities.

Builds More Equity

Did you know that each and every time you pay a mortgage payment you are decreasing the amount of debt that you owe and increasing the amount of equity in the property? That means if you own a two- family property and are using the rental income to help pay your monthly mortgage payment, your tenant is not only helping you pay down your mortgage debt, they are also helping you increase your equity position. There is something else to factor in the building equity faster equation. Real estate has historically gained value over time. That means your property will gain value over time as well. For example, let’s say that the real estate market increases by a conservative estimate of 15% over the next three (3) years. If you purchase a single-family home or condo for $650,000 your real estate will be worth $747,500 in three (3) years under this scenario.

That means you have gained $97,500 in equity. Not too shabby. However, if you purchase a 2-family home for $699,000 your real estate will be worth $803,850 in three (3) years under the same scenario. That means you would have gained a whopping $104,850 in equity. Although your purchase price may be more for a two- family home compared to a single family or condo, the rental income will help offset the difference in your monthly mortgage payment.

Builds Wealth

Did you know that most of the wealthiest people across the United States have built their fortunes by investing in real estate. Did you know that most of that wealth creation was focused on rental properties that generate monthly income? This is due to a basic real estate principle. First and foremost, as written above, real estate gains value over time. Time is the friend of all real estate. There is an old adage that goes “Don’t wait to buy real estate; buy real estate and wait.” Real estate nearly always has the long term propensity to continue to go up. Land is a fixed asset and our world population continues to increase and we are not creating more land.

Even when the real estate values happen to drop, they tend to bounce back stronger than ever over time. It is never a bad idea to buy investment properties when economic conditions appear weaker. If you time horizon is set to the longer term and you are thinking about generational wealth – just keep buying properties as you can. The more units you own the more your wealth will grow.

Let’s use our earlier example of building equity. If your two- family property gains $104,850 in value/equity in a three (3) year period, imagine how much equity you would have built if you owned two or three or even four two- family properties? That is why most real estate investors leverage that equity and use it to purchase additional investment properties. Buying investment properties can be a positive addictive habit of taking distressed properties and repositioning the asset and making it even better. There is great satisfaction in taking a substandard property and having pride in turning it into a much better product and collecting better rents in the process.

Creates a Passive Income Stream

When you own a two- family home your tenant is helping you pay for your monthly mortgage payment. If you decide to move out at some point down the road, you can rent out the other unit. If you rent out both units you should have enough rental income to not only cover your monthly mortgage payment, but to also provide you with a nice profit. That profit is called passive income, which by definition means “income that requires little to no effort to earn and maintain.” If you use the equity or some of the equity from your two- family property to purchase additional multi-family properties, you will earn even more passive income. Depending on the amount of properties you own, the amount of time you have to manage the properties, and the profit margin that you are earning from the rental income, you may want to manage the properties yourself. Managing properties does take time, and the most successful investors have the best organization skills and are very responsive, but that’s for another article.

Property Management

You may also choose to bring in a professional property manager in order to take the property management tasks off your hands. Although it will reduce your profit margin, the rental income will become truly passive income at that point. You can also seek the advice of top apartment leasing firms that have a long impeccable track record of delivering the best tenants coupled with the highest rents. Not all property management companies are created equal and it highly important that you deeply investigate their ability to deliver to you a zero percent vacancy rate. Some property management companies are good at managing repairs but lack the resources or depth to get your property rented to it’s best and highest use. You will want to make sure to ask their leasing practices and ask for at least 3 references from other landlords using their services.

Less Competition

Did you know that most areas surrounding Boston, MA are currently experiencing a seller’s market? That basically means that there are more buyers out there looking to purchase properties than there are properties available for sale. So, what that does mean to you as a buyer? First and foremost, sellers are typically selling their properties for top dollar. In a great deal of cases the real estate is selling for over asking price because multiple buyers are interested in purchasing the same property. That can easily lead to a bidding war, which of course drives up the purchase price of the property. That is never a good position for buyers to be in, but if they want the house bad enough, they are willing to overpay for it.

In addition to the higher purchase price, a seller’s market also means that the seller has more leverage than the buyer when it comes to the terms of the sale. Most of the single family homes that are selling in MA right now are in very good shape with little work that needs to be completed. Most people that are moving do not want the hassle of having to do repairs and renovations before moving in. That can severely limit your search. Multifamily properties are often different where you actually desire to find a property that needs a little work because you can dramatically increase the value and rents of the property.

Seller's Market vs. Buyer's Market

In a tight sellers’ market for single family properties; you are often limited in what you can negotiate. For example, the home inspection may reveal that there are a bunch of small issues that need to be fixed. Since it is a seller’s market, the seller most likely will not be willing to fix those issues or pay to have them remedied. If that is a deal breaker for the buyer, the seller knows someone else will pay top dollar for their property.

However, if it were a buyer’s market, chances are high that the seller would be willing to fix the item(s) because he or she doesn’t want to lose their buyer for any reason. The good news for homebuyers who are interested in buying two- family homes is that the vast majority of first- time homebuyers are looking to purchase single-family homes and condos. That means you will be facing less competition when shopping for and purchasing a two- family. It also means that you may be able to purchase your two- family property at a better deal and/or for better terms. There are always investors who purchase multi-family homes, so if you find one that you like, make an offer and get the ball rolling sooner rather than later. You certainly don’t want to lose out on a great property by waiting.

Take A Look At Prevailing Rents

One of the items that you will probably want to gain some insight and mastery on is understanding rent prices in the area you are considering purchasing. Rents can vary greatly by neighborhood. There are a ton of factors to consider. You might want to talk with an apartment leasing expert that know rents well in your chosen area. The best scenario possible is to work with a dominant apartment leasing company that has several multifamily sales experts that can provide you with private off market multifamily opportunities. If you are stuck working with an agent that is a residential single family real estate agent – chance are you will not be exposed to many of the best multifamily deals. We will go deeper into this content in other blogs.

The Choices Are Yours to Make

When you purchase a two- family home you are in control of the real estate. That means you get to choose what color you want to paint the exterior of the house or if you want to have vinyl siding installed. You also get to decide on the landscaping features, and interior features of your new home. For example, you may decide to have wood floors installed, or new carpets. You may want to have the light fixtures changed, or the plumbing fixtures updated. The bottom line is that you are in control of the property and get to make all of the decisions without asking for permission. It is your home to do what you want with it. The only difference of owning a single- family home in this regard is that you should always take your tenants into consideration when making changes and improvements.

For example, if you are planning any home improvement projects let them know ahead of time. You will find that it goes a long way in building a positive landlord/tenant relationship. It also never hurts to meet with an apartment leasing expert that knows what the latest styles and preferences are for apartment layouts as well as fit and finish. The results of a knowledgeable apartment leasing agent should never be underestimated. They know what rents fast and they also know what sits on the market.

A Two- Family Home Is a Great Way to Start Investing

In conclusion, when purchasing your first home it is important to think outside of the box. This holds particularly true in a seller’s market where most single-family homes and condominiums are selling for incredibly high prices. In the vast majority of cases, both single family homes and condos within Boston and surrounding areas are selling for above the listing price. Do not let this price you out of the market. Instead, you can turn to an alternative solution that could very well end up being a far better investment for both the present and future. Two- family homes can be great places to live, and the perfect way to start building your real estate portfolio. In fact, your two- family property purchase may very well end up being the foundation of your real estate empire.

It is important to work with a professional real estate agent that not only specializes in helping first time home buyers but is also incredibly well versed in the Boston multi-family real estate market and understands the rental process. You will most likely want to work with a proven leader of the apartment leasing and multifamily sales industry. If you are a first-time buyer, we are here to help and make sure that your home buying process is as smooth and seamless as possible. If you are looking for additional resources, please check out the First-Time Home Buyers Home Buying Resources section. There is a lot of great information for you there. In addition, the Boston Pads website is also full of valuable home buyer's information and data including the most comprehensive list of Boston MA multi family homes for sale, and surrounding areas.

Our team have numerous highly skilled real estate agents that can help you make a decision on your first investment property and how it might be a far better choice than a single-family home. We look forward to working with you.

Demetrios Salpoglou

Published January 8, 2024

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.