Boston’s apartment rental market entered 2024 in a similar position as it began in 2023. Overall rental inventory is extremely low and prices are still trending upwards as they were throughout all of last year. Apartment availability has increased slightly year-over-year compared to January of 2023, but not enough to flatten out rent prices. With little relief on the horizon in terms of new rental supply, this trend is unlikely to change in a big way in 2024. These are the trends driving Boston’s apartment rental market in 2024.

In this Report...

- Rental Unit Scarcity Has Eased But Inventory Still Tight

- Rent Prices Still On The Rise in Boston

- Average Time on Market for Boston Apartments Up

- Boston Apartment Rental Market Trends in 2024

- 1. Boston’s Construction Boom Has Stalled Out In Recent Years

- 2. Inflation Crippling The Market For New Construction

- 3. City Policy Must Deliver More Housing

- 4. Boston’s Changing Demographics

- 5. Priced-Out Buyers Are Still Renting

- 6. Rent Control Is Dead For Now

- 7. Boston Labor Market May Level Off in 2024

- 2024 Boston Apartment Rental Market Predictions

Rental Unit Scarcity Has Eased But Inventory Still Tight

The current Real-Time Availability Rate (RTAR) for Boston apartments is 3.91%. That figure is up +13.66% year-over-year, but still lower than the long-term historical averages for this time of year. In the years before the pandemic, apartment availability would typically be in the 4-5% range by mid-January. We have not seen that trend come to fruition in the past two years and 2024 is no exception.

A look at the Real-Time Vacancy Rate (RTVR) paints an even bleaker picture for the 2024 rental market. Boston’s current RTVR is 0.61%. While that figure is up +10.91% compared to this time last year, it marks the 113th consecutive week of less than -1% occupancy in Boston. This is a clear departure from historical vacancy trends in Boston, where vacancy would always spike to 2-3% in the first week of September. There also remains a very strong appetite for renovated apartments which often rent before they are even move-in ready. Numerous apartments will often receive offers while still under renovation because there is still a quite strong demand for an updated living space.

With rental inventory remaining so low, landlords are in the driver’s seat in Boston. As a result, average rent prices have been rapidly ascending over the past 24 months. Much of the increase in rents however is due to skyrocketing costs from nearly every angle for landlords. We will delve into this more further in our article.

Rent Prices Still On The Rise in Boston

The current average rent price in Boston is at an all-time high of $3,255. That figure is up +8.97% year-over-year. Interestingly, rent prices for smaller units (Studios, 1 bedroom, and 2 bedroom apartments) have leveled off slightly more since September 2023, while larger units (3 bedrooms +) continue to climb. Generally speaking, larger bedroom count units do receive faster wear and tear than smaller bedroom count units. The proclivity of more people coming over to larger sized apartments for various events and activities has remained true for decades. With landlords costs skyrocketing on keeping their apartments in great shape; property owners have had to raise their prices more in the larger bedroom count units. There has also been greater demand for larger bedroom count apartments because of the perceived cost savings due to shared utilities which have also significantly increased.

There is some early data that could be suggesting that prices of smaller units may hit a ceiling and that demand has leveled off at current pricing. Boston renters appear to be gravitating towards shared spaces where they can reduce their overall living costs as opposed to renting a smaller unit for a higher price. This could be an early indicator of overall rent prices possibly flattening out in the latter half of 2024. Property owners tend to put out their smaller units for rent later in the leasing season because they require less people to make a decision. It will be interesting to see what type of data points start to gain traction as we approach the middle of April.

Average Time on Market for Boston Apartments Up

Our most recent Boston apartment data shows that the current median days on market for an apartment rental is 17 days. That is down 4 days when compared to early February 2023, when average days on market hovered between 21 and 23 days. This reduction highlights the ongoing strong demand for apartments, with supply not meeting this demand adequately. If the median days on market rises above 20 days, coupled with an increase in the RTAR, then we could seriously entertain the possibility of rent prices beginning to soften in Boston.

Frequently, a minor price reduction is sufficient to lease a unit that has been on the market longer than the area's median days on market.

Boston Apartment Rental Market Trends in 2024

The predominant trend in Boston’s rental market is still supply scarcity. Anything acting as a lever to housing supply will be under a microscope this year as the city is in dire need of additional rental inventory to ease soaring prices. Here are some of the main trends that could affect supply and pricing in 2024.

1. Boston’s Construction Boom Has Stalled Out In Recent Years

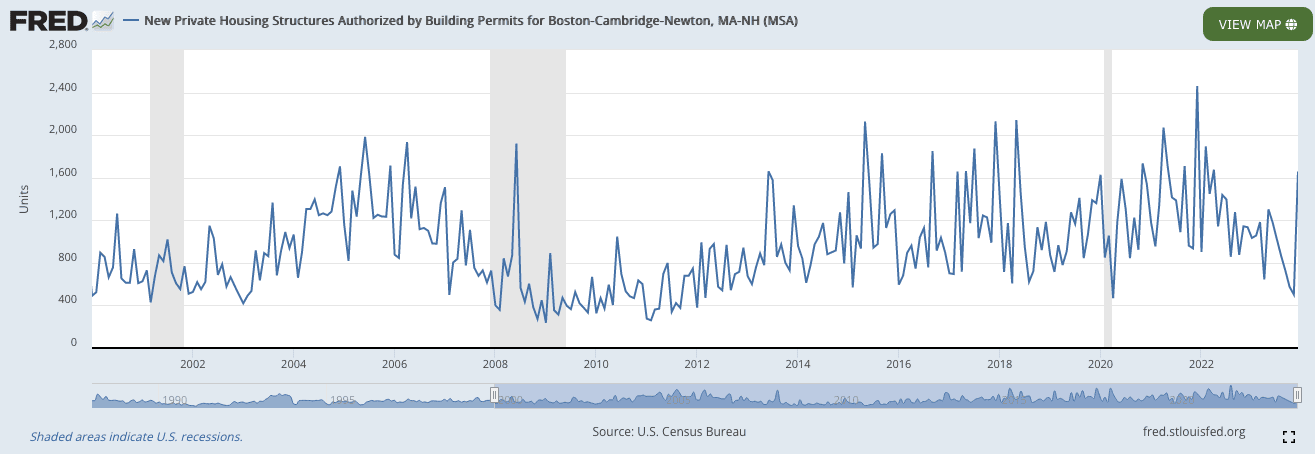

In our 2023 Boston Apartment Rental Market Report, we reported on a lackluster 2022 in terms of new housing development in Boston. Based on available data, that trend has worsened in 2023. According to Axios, 2023 new apartment units constructed dropped by -21.4% compared to 2022 and has been on a downward trend for 4 years. That lack of production can only exacerbate the supply shortages we’re currently seeing in the local apartment rental market. Boston is still a very popular place to acquire a wide variety of high income occupations. Unless job availability changes dramatically; we could be in for more housing challenges.

If new housing permits increased last year, we would at least have some sliver of hope in sight for new product arriving in roughly two to three years. In development, you have to think years ahead. Most permits provided today are usually developments that show up ready to be rented or sold about two to three years later. We have two development problems occurring in Boston. Not only are new development opportunities scarce but many of the approved projects are stalled by current economic conditions and coupled with bad policy. It would appear we have a supply challenge according to the St. Louis Fed numbers. Boston metro issued permits for 3,352 new units to be constructed through November in 2023, down -13.2% compared to the same period of 2022.

2. Inflation Crippling The Market For New Construction

Over the last two years, inflation has wreaked havoc on the economy both domestically and locally. The Fed raised rates 6 times in 2022 and another 3 times in 2023, which prompted many developers to halt projects and wait out the storm. Increases in the price of diesel fuel caused the cost of construction materials to soar, adding up to even more costs for developers. Should energy costs reverse and decline going into late 2024 and 2025 this could stimulate more housing production as the “math” on the development itself will become more favorable.

According to a report by the Boston Globe, it now costs $600,000 to finance and build a new unit of housing in Boston. That makes it very difficult for developers to make new projects profitable. Without a doubt, this trend is contributing to the lack of new housing supply hitting the market. This has rippling effects on both the apartment rental market and the sales market as we noted in our 2024 Boston Real Estate Market Forecast. To be clear, labor costs are very high and coupled with high affordability and green requirements within a new development – this is having a crushing effect on our developers from moving forward and bringing forth more supply.

3. City Policy Must Deliver More Housing

We noted in last year’s market report that the city must do more to facilitate new inventory creation. Since then, Mayor Wu did outline plans to remove restrictions on building ADUs (Additional Dwelling Units) in her 2024 State of the City Address like we suggested. While long overdue, this is a great first step in bringing more product online at a lower price point through using existing plots and footprints. However, more must be done to make Boston a more attractive city for property developers. It might be high time that we accept the economic limiting realities of: high interest rates, tough borrowing conditions, more expensive green regulations, high energy and labor costs and over ambitious affordability requirements in the deals themselves. The most common words spoken in the development community right now are "most deals don’t pencil." Math is math.

City hall could move forward with more incentives and better subsidies for development companies. Providing easier paths to developments would be especially helpful to the smaller neighborhood builders. Generally speaking, there should be a fair and robust implementation of helping smaller developers get projects off the ground in a much faster manner. There are also lots of antiquated zoning practices that could be overhauled to help relieve some of the financial obstacles related to building in Boston. Much of the city’s policy is focused on the creation of affordable public housing, which is great, but that alone won’t come close to improving the supply issue. The current administration must forge a better path for developers to keep investing in Boston. To be clear, this is one of the most challenging times to get viable development projects off the ground in nearly two decades. We got to this lack of production in housing not through one bad decision but a mixture of unfortunate occurrences where the sum of each action combined to form a breaking point in the development cycle.

4. Boston’s Changing Demographics

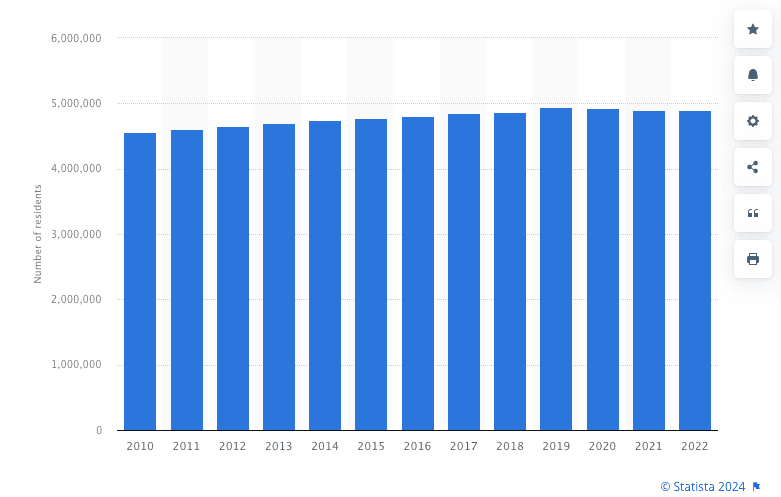

The Boston metro region is experiencing a decrease in population for the first time since the 1980s, albeit at a very small margin. According to Statistica, the Boston metro area saw a net loss of roughly 30,000 residents since 2020, which accounted for a small -.83% decline. While many people will debate this number indicating that we have a younger, more transient and international flair to our city due to a number of factors. More on that later…

Assuming we stick to the information quoted above, a declining population would certainly reduce overall demand strains on the metro housing supply. However, I think we can all agree that is not the best solution to the supply issue. Still, a -0.83% decrease is not enough to have any meaningful impact on housing availability. If the trend continues and worsens, that could change in the future, but most people do not want to see that come to fruition. Boston is a great city and I think most people want to see it grow and improve and innovate its housing stock akin to how we improve our tech, medical and financial products and services.

Boston's population base is evolving as well. We highlighted in our 2024 Sales Market Forecast that Boston’s median household income is growing at a much faster rate than CPI over the last 12 years. This can be attributed to the relentless influx of venture capital that has flowed to Boston in recent years. The typical Boston renter is no longer the blue collar worker of the 1900s. We have to develop and cater to the clients that want to move to Boston to help build the next great companies of tomorrow in our state. All housing that we produce is good. The more we produce the greater the chance prices can stabilize and become affordable. Anything that slows down or impedes development just makes prices go higher and that often keeps the best and brightest from staying and growing a new company in the Greater Boston Area.

5. Priced-Out Buyers Are Still Renting

The interest rate hikes we experienced in 2023 kept a lot of buyers out of the marketplace. We saw a lot of tenants re-sign leases with their current landlord because home sale prices did not go down in any meaningful way across most of Greater Boston. Until home prices fall or interest rates decline, we will continue to see high prices on apartments in Boston. Inflation has also sapped a lot of the consumers' excessive purchasing power because so many daily items have gone up in price in a dramatic fashion. Few prospective buyers can afford to buy in today’s Boston’s real estate market. Most current owners are locked into dramatically lower mortgage rates and will not sell unless they have no other option. As a result, Greater Boston area renters are staying longer than they may have in their same apartment. The overall lack of turnover in both the sales and rental side exacerbates the effect of rents going up because landlords go out and look to see their competition for their unit and they are not finding a lot. When a property owner knows that they do not have much competition; they tend to keep their prices higher and for a longer period of time. The average days on market for an apartment in Boston is 17 days. Clearly we still have a tight rental market.

There will be a lot more real time rental analytical data that shows up later in April as the peak of rental inventory starts to make its way into the availability pool. It will be interesting to see if being in the same apartment for several years starts to wear on people as they clamor for more choices. Since the end of the pandemic; Greater Boston has seen less turnover than we would normally witness. Rising rental prices are also a strong driving factor in people not moving.

6. Rent Control Is Dead For Now

Rent control was resoundingly defeated once again in 2023 on numerous levels of government in MA. The myth and misinformation of rent control was out in full force in 2023. Behind closed doors and at various swanky fundraisers nearly every politician knows and will privately tell you that rent control is a terrible idea. Most of them know beyond a shadow of a doubt that rent control has been historically proven across multiple cities across the country to reduce supply and harm both existing and future stock supplies and quality of housing. While misguided virtue signaling will still be the norm for some die hard politicians in 2024; the vast majority of both our population knows that is a failed and flawed policy. Rent control has never worked and diminishing supply eventually always leads to higher pricing.

The question many people are asking themselves is will the lack of rent control in 2024 cause prices to go up faster this year than last year? The answer is no. In fact, due to a combination of high inflation and fear mongering of the threats of rent control in 2023– many landlords already raised their rental prices. In a somewhat twisted turn of events; the heavy push for rent control in 2023 caused many landlords to significantly raise their rents last year. Numerous landlords were actually scared they would not be able to raise their prices in the future so they decided to pull the trigger last year. Let’s hope that we finally move away from the unpopular and caustic discussion of rent control and focus the dialog on clear paths to increasing production.

7. Boston Labor Market May Level Off in 2024

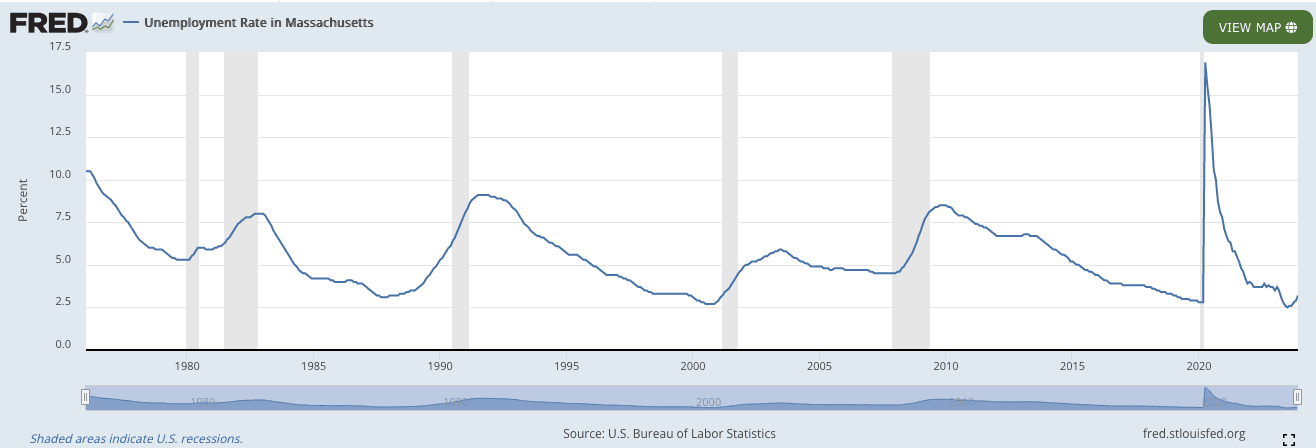

Boston’s labor market is still looking strong to start off 2024. The most recent unemployment rate in metro Boston is at a healthy 2.6%, up slightly from 2.4% in September of 2023 which happened to be the lowest level recorded since 2000.

It looks like the metro’s unemployment rate has flattened out, and it’s hard to imagine dropping down any lower than its September level of 2.4%. Last year, Boston shed about 4,000 tech jobs according to the BBJ, and just in the last month Wayfair, State Street Corp, and HubSpot all combined to lay off thousands more in the Boston area.

The most recent venture capital data also foretells a sluggish labor market to come. According to PitchBook’s 2023 Q4 Venture Monitor, 2023 saw another significant decline in total venture capital nationwide. Boston is still the 4th largest market in the US for venture capital, but saw a steep decline in total venture capital invested compared to 2022. This could mean that job growth will slow down in Boston this year, and we may see unemployment creep back up towards the 3% level by the end of the year.

2024 Boston Apartment Rental Market Predictions

There were a lot of complicated economic and political forces at play in 2023 that contributed to us missing our mark in our rental predictions. Last year we believed that impending job losses in technology coupled with inflation would start to derail the rent growth train. The endless media rumors of massive job layoffs coming never materialized. We also underestimated how much the threat of rent control potentially passing in 2023 would impact landlords decisions to raise prices. We also did not expect insurance companies, labor and material costs to either remain high or continue to increase in the real estate sector. Our 3% rental prediction was dead wrong because rent shot up to 10.56% across all apartment sizes for the city of Boston. There is no way to spin this – we were wrong.

Perhaps Boston is even more resilient to a deep recession than ever before? Could it be that our vast and varied highly skilled job market beats to a different drum? Could our high wage increases for many in Greater Boston make it easier to absorb these upward rent prices? Did the imminent threat of rent control coupled with rising costs cause more landlords to raise their rent than we predicted? Did the dearth of new apartment supply contribute to rising prices? Did we underestimate the total amount of price hikes imposed on landlords throughout their entire ecosystem? Is it possible that we were simply too early in our predictions and that a deeper recession manifests this year?

There are so many things to consider when you start to try to predict our rental market. The last time we were wrong in our market forecast we went through a major pandemic that no one could foresee. Clearly today we have far more political instability and wars raging across the world than we did even 2 years ago. Boston being an international city can certainly be impacted by unforeseen world events. However, the lack of local housing supply and development coupled with low unemployment is always a heavy weighted average in our rent prediction formulas.

We are going to have to get more innovative and creative on increasing supply for the next several years. Not to beat a dead horse, but City Hall can and must do more to keep Boston’s housing market off life support. Reconsidering tax incentives for developers and cutting red tape for new construction projects must be an agenda item for 2024 if we are ever going to start to get us out of this supply crisis. If the Fed lowers interest rates this year, that could spur some projects to move forward, but none of it will be here in time to make a difference in our rental forecast for the year.

Early indications of rental pricing near universities shows robust increases greater than 10% this year. Numerous leases have already been signed for both 6/1/24 and 9/1/24. That being said, it is quite fair to say that wear and tear including damages to rental stock tends to be more accelerated and severe in close proximity to universities. Landlords have seen massive increases in dealing with wear and tear issues in the past two years. Landlords already know it is costing them more than ever to bring an apartment back up to rentable standards. Therefore it could be a tale of two rental markets. The market closest to universities may have a higher rental increase of 10% this year to offset pricing increases while other areas see rental prices only rise 4-6%. These predictions are based upon not seeing any massive layoffs or world impacts having undue outside influences to our city of Boston.

We will continue to monitor these trends as they develop. Look for us to provide another report in late April or early May to provide additional apartment leasing insights.

Demetrios Salpoglou

Published February 9, 2024

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.