As of September 20, Boston’s rental market looks very different than in recent years. In neighborhoods long considered bulletproof—Mission Hill, Fort Hill, Fenway, and Symphony—apartments are sitting empty well past the traditional September 1 turnover date. Vacancy rates in these student-heavy areas are significantly higher than historic norms, giving landlords a jolt of concern. For example, the Mission Hill Real-Time Vacancy Rate (RTVR) is up 43.48% from last year, and 251.06% from two years ago. It is currently at 1.65%.

It’s true that this year feels unusual. Delays in international student arrivals, tighter graduate school enrollment, and a more balanced supply-and-demand picture have shifted momentum back toward renters. Landlords are now covering broker fees at levels not seen in years, and some are offering concessions to compete.

While the adjustment is real, there’s no reason to panic. A cooling market does not mean a collapsing one—it means landlords need to recalibrate expectations and rely on data-driven decisions. A vacant apartment in Boston is also another sign that it might be time to do some upgrades to compete with other more modern apartments in the area. The four areas mentioned above have had some serious updates and upgrades to it’s housing stock since the Pandemic so you might just be behind your housing competition.

International Students: Demand is Delayed, Not Disappearing

One of the biggest storylines this fall is international students. Many delayed signing leases due to visa processing issues or hesitation about political and economic uncertainty. In past years, international demand soaked up apartments in Mission Hill and Fenway months in advance. This year, units are still sitting as of late September. It is what it is.

Many universities in the area also overweighted in international student enrollment and looked at it as an endless cash register of funds. For over two decades these universities have quietly increased international student enrollment and had an abundance of candidates to choose from. That being said – no business plan is bullet proof and unexpected changes can hurt the surrounding real estate operators.

Just because international students didn’t show up in huge numbers does not mean the demand has vanished. Universities in Boston continue to enroll tens of thousands of international students annually, and many will still sign leases later than usual, for the Spring semester. For some landlords, this is a reminder that the timing of demand has shifted a bit—planning for a late-season leasing wave can help avoid unnecessary stress. It also means this is a good time to make improvements during the next few months to make your units competitive as well as maximize your potential monthly rent. Landlords can still fetch a great January rent in these areas if they put some energy and effort into making them look as nice as possible.

Why Data Matters More Than Ever

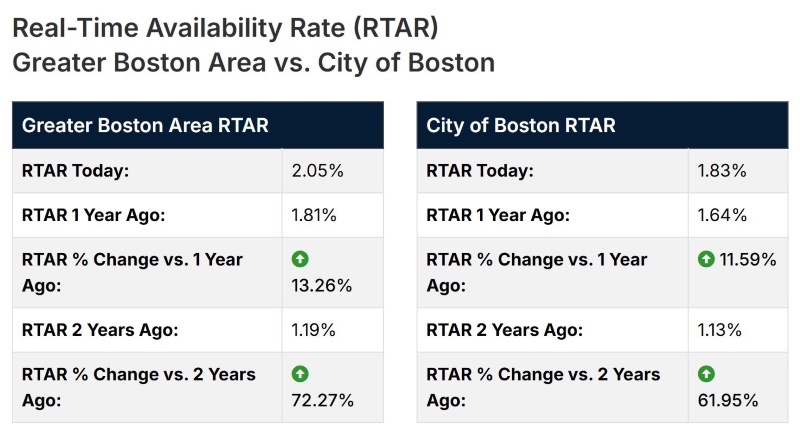

In Boston's rental market, guesswork is risky. Setting rents too high, assuming students will fill every vacancy, or waiting too long to offer incentives can leave units sitting idle. By contrast, landlords who follow real-time data—vacancy rates, price trends, and neighborhood leasing velocity—are better positioned to adapt. Many landlords in the Allston area carry a heavy load of international students – yet they came out of this dilemma mostly unscathed because they talked with leasing experts and adjusted downward more quickly on price and incentives.

For example, this September the vacancy rate for Symphony apartments rose from under 1% last year to nearly 2%. Mission Hill and Fort Hill are seeing far more units still available compared to prior years and prices began to fall. Landlords and property managers need to take sage advice from leading real estate offices that know how to rent properties. There are a lot of big box “national brands” that do a poor job in leasing because they run residential sales departments that know little if anything when it comes to leasing cycles. Property owners need to make sure they are working with the best that can tell them exactly how their apartment stacks up against others.

Leaders like Bostonpads.com have built custom data solutions that help landlord price their properties with pinpoint accuracy. Scalable real time data coupled with boots on ground professionally licensed real estate agents can make all the difference in the world. Real estate agents can help you stay flexible and relevant on pricing and incentives early so you don’t get left behind. Prices can tumble in certain neighborhoods quickly and only professional leasing agents can give you the week by week playbook on how to get you rented.

Practical Ways to Stay Competitive

Landlords don’t need to make big slashes in rents across the board to stay competitive. Instead, small adjustments can make a big difference:

- Price units realistically from day one using neighborhood-level, real-time data. Trust companies that rent thousands of apartments each year.

- Work with local industry professionals that specialize in leasing and multifamily investments. Ask real estate companies – especially the national brands what type of local software they have to show you real time pricing.

- Offer incentives—cover fees, flexible move-ins, or modest concessions—before vacancies drag out. Talk with leasing professionals that know the best incentives to get your apartment closed asap.

- Highlight features most important to students, such as proximity to transit, Wi-Fi readiness, and even furnished options. Meet with brokers that know the competition and can explain it to you street by street.

- Market aggressively with professional photos, virtual tours, and broad online distribution. Say clear of residential sales agents that start pressuring you into a panic sale. Talk to industry leasing leaders first.

These strategies not only help fill units faster – it can help you build relationships with quality real estate companies that know what their doing and have your best interests in mind.

The Bottom Line

September 2025 has reminded landlords that Boston’s rental market is cyclical. Student-heavy neighborhoods like Mission Hill, Fort Hill, Fenway, and Symphony are experiencing vacancy spikes, and the days of automatic lease-ups are on a temporary pause for now. However, history shows demand—especially from international students—remains strong over time. Perhaps it is time for you to reach out to quality apartment leasing platforms that can tell you the best methods to get your places rented for optimum value. Leasing patterns change from year to year – and you need a trusted advisor.

Rather than panicking, landlords can protect their investments by working with true leasing professionals, staying realistic, leaning on real time data, and adapting strategies. Adjusting expectations, and making units more attractive are not signs of weakness—they are smart, forward-looking moves that keep properties performing even as the market cools in certain neighborhoods.

Demetrios Salpoglou

Published September 22, 2025

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.