Boston has rocketed up the list of most expensive places to live in the United States over the past decade. As of now, Boston is the 3rd most expensive city to rent an apartment in the U.S. behind San Francisco and New York City. The Boston Herald predicted that Boston could overtake San Francisco at #2 on that list back in January 2022. Since then, rent prices for Boston apartments have been steadily rising, even surpassing previous all-time highs set before the pandemic. Let’s have a look at how expensive it is to rent an apartment in Boston.

What Is the Average Rent Price in Boston?

According to the most recent Boston rental data, the average rent price for an apartment in Boston is $2,779. That figure is up +7.29% compared to a year ago. The following table compares the average rent price of the Greater Boston Metro, the City of Boston, and Boston’s immediate suburbs for all sized rental units.

| Area | Studio Avg. Rent | 1BR Avg. Rent | 2BR Avg. Rent | 3BR Avg. Rent | 4BR Avg. Rent | 5BR Avg. Rent | Average Rent |

| Greater Boston Metro | $1,874 | $2,167 | $2,681 | $3,228 | $3,971 | $4,791 | $2,692 |

| City Of Boston | $1,867 | $2,202 | $2,707 | $3,214 | $3,906 | $4,777 | $2,708 |

| Boston Suburbs | $1,895 | $2,091 | $2,638 | $3,256 | $4,098 | $4,819 | $2,662 |

Why Is Rent So Expensive in Boston?

The predominant reason why rent is so expensive in Boston is quite simple: the supply of apartments is not keeping pace with rising renter demand. As the metro population has grown over the past decade, Boston’s apartment inventory has failed to keep up. As a result, average rent prices have increased every year during that time span with the exception of the pandemic years. Here are 8 main factors that are causing rent to rise in Boston.

1. VC Funding Flowing To Boston

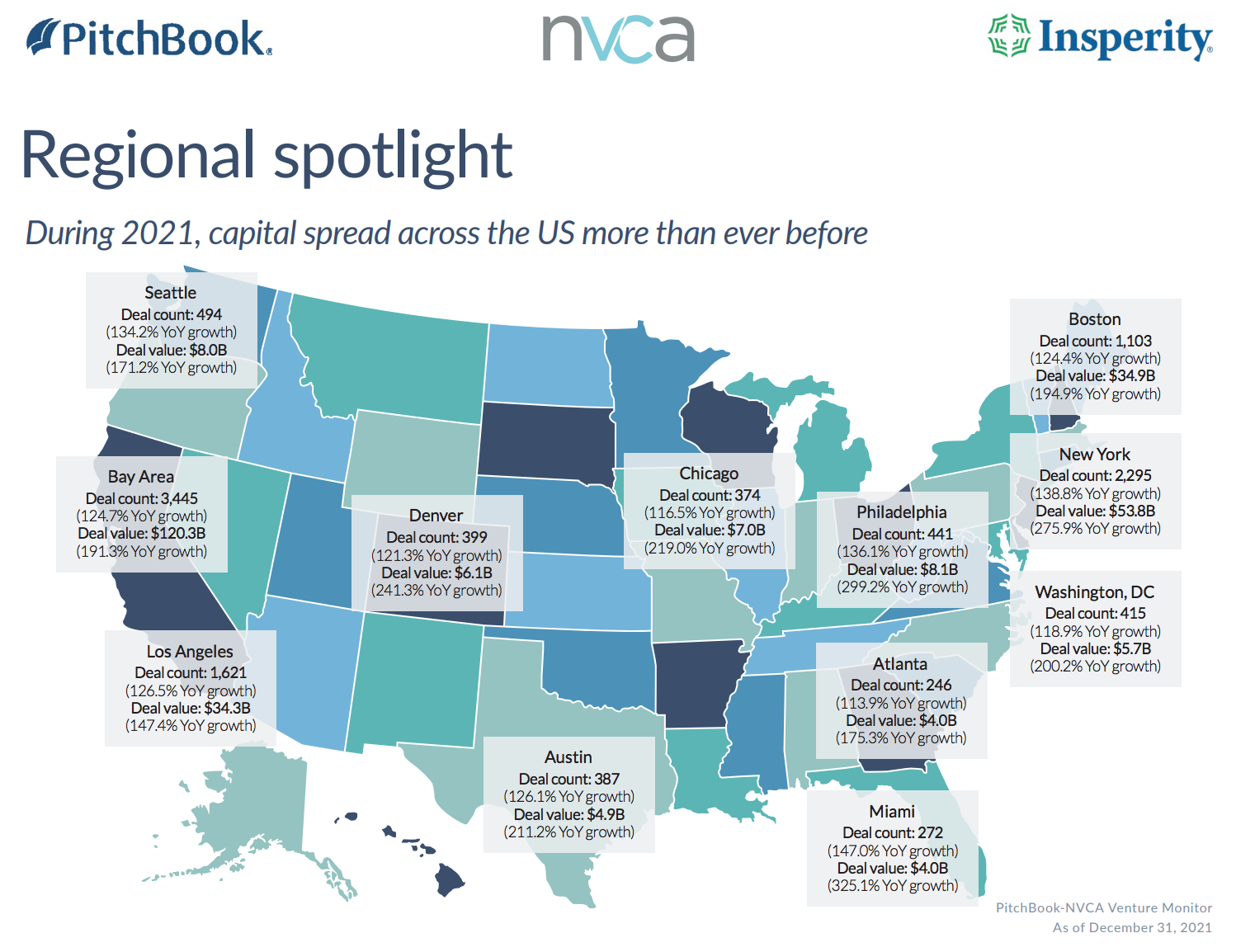

One of the primary reasons Boston’s population is growing is venture capital. Boston has become one of the biggest tech hubs in the country over the past decade. According to Pitchbook’s Venture Monitor, the Boston metro attracts the 3rd most venture capital out of all U.S. cities behind, you guessed it, San Francisco and New York. That has placed additional demand on an already tight housing supply, which has put upward pressure on both average rent and median home prices. There is also massive diversification of various small companies within the tech and health-tech related fields. By our industries being so broadly based in all these new and exciting companies it tends to mitigate a big segment of an industry losing steam at once and causing housing demand to decrease. Therefore Boston’s massive diversification in tech related start ups tends to create far more demand for housing than traditional static or mature industries.

2. Increasing Enrollment At Local Universities

2. Increasing Enrollment At Local Universities

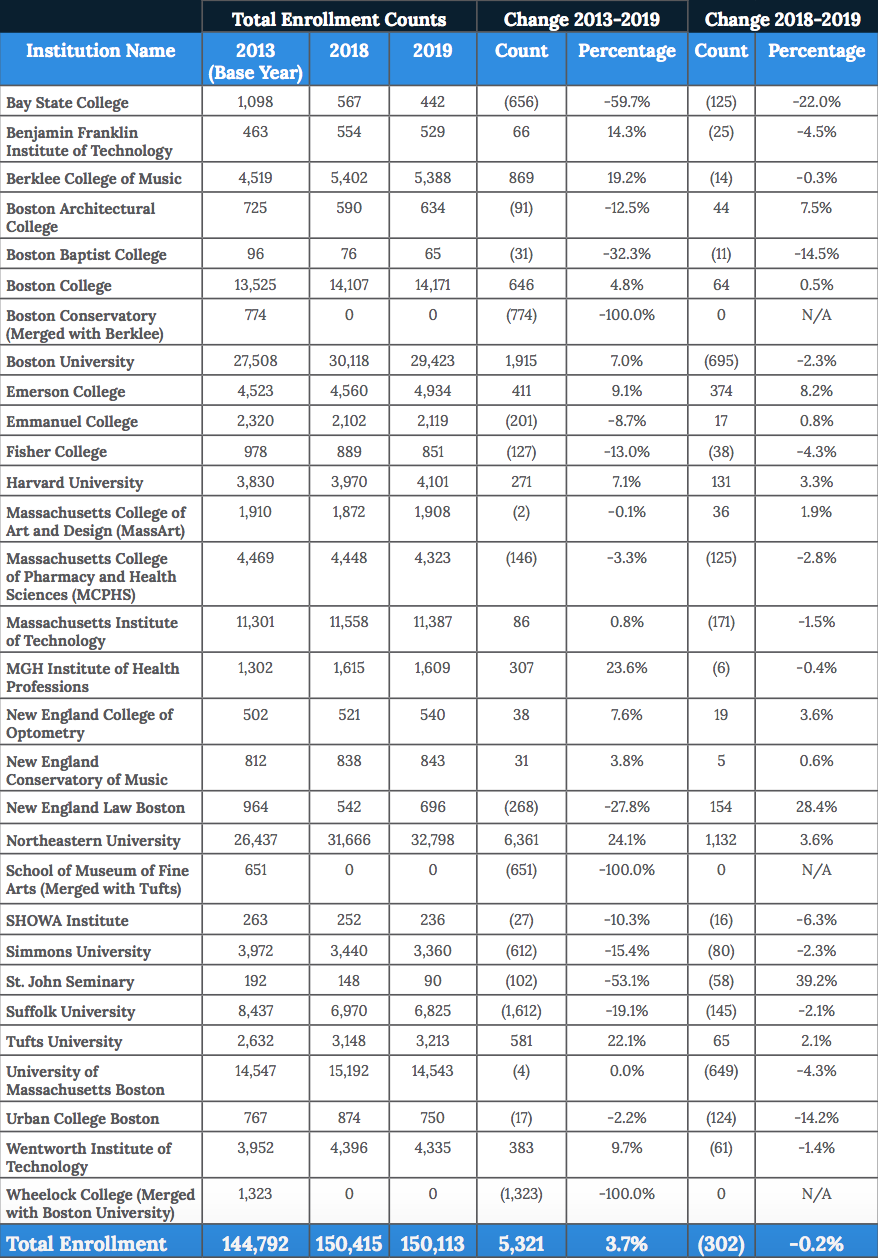

One of the other factors contributing to population growth has been the growth in the college-level student population. Boston is home to dozens of world-class colleges and universities. According to the most recent Student Housing Data from the City, the number of students enrolled at those educational institutions increased by 5,623 or 3.9% from 2013 to 2019. According to the report, 66% of Boston’s 150,415 students live off campus, so you can imagine how much demand that puts on Boston’s apartment inventory.

3. New Construction Challenges

One of the reasons Boston’s rental supply hasn’t kept pace with rising demand is because of new construction challenges. Boston is geographically small. Additionally, it is one of the oldest cities in the United States and has undergone hundreds of years of development already. There just isn’t enough developable land to build on. The city has made it an initiative to add 69,000 new housing units in Boston by 2030, but much of that development was slowed down during the pandemic. Now we’re facing record low apartment supply as a result.

4. Record Low Apartment Supply

As a result of the previous three points, Boston is seeing record low levels in vacancy rate and apartment availability in 2022. The current real-time vacancy rate (RTVR) is 0.47% after hitting an all-time low of 0.40% at the end of last month. The current real-time availability rate (RTAR) of 2.59% is down -45.13% compared to pre-pandemic levels in July 2019. That means renters are seeing roughly half of the number of available apartments as they were before COVID.

5. Record High Inflation

To exacerbate the issue, we’re seeing inflation cause rent prices to climb even further in 2022 than anticipated in Boston. Rising prices for: diesel gas, labor, and materials has increased the cost of maintenance for property owners. Whenever that happens, the costs will always trickle down to the renter, and we’re seeing it in the form of rent hikes in 2022. There’s no industry that escapes bad fiscal and energy policy, and Boston’s rental market is no exception. As a result, the average rent price is up +7.28% year-over-year.

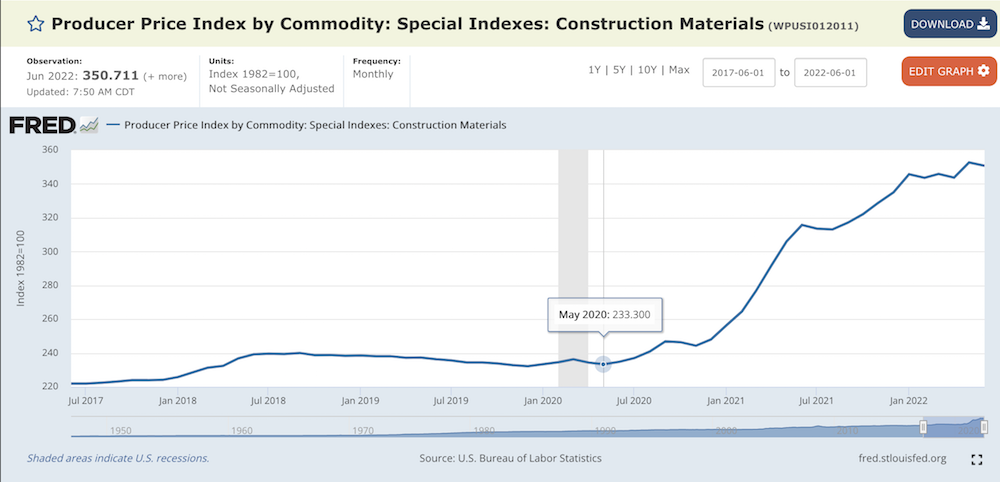

6. Record High Energy Costs

Rising energy prices are driving up the cost of development. The construction industry relies on large machinery to transport and install heavy building materials. Large freight vehicles and tractor-trailers run on diesel fuel, so when energy costs soar, so does the cost of manufacturing, transporting and installing materials. You are not bringing steel beams to a construction site on a Prius. For the construction industry to be able to pencil a deal to make it work – high energy and bad fiscal policy needs to be taken into account. While the consumer price index is up 8.6% year-over-year, the producer price index for construction materials is up 53.81% over the last two years. Higher cost of building materials means higher cost of repairs for property owners. Those additional costs will get passed down to the renter.

7. Development Disruptions

We are still experiencing a labor shortage coming out of the pandemic. The labor participation rate has yet to catch up to pre-pandemic levels, and development projects in Boston have been slowed down as a result. This adds more costs to developers in the form of higher labor prices and carrying costs of paying taxes, utilities, and loans during construction. Higher costs for developers means higher costs for buyers and renters. We need to get more people back to work and off the sidelines. Numerous bad habits and lost skills happened during the pandemic.

8. Supply Chain Disruptions

Another factor driving up costs for developers in supply chain disruptions. The pandemic had a profound impact on the transportation of building materials. Many manufacturing plants were shut down during the pandemic, causing shortages in building materials. Harsh lockdowns in China created a backup of shipping containers, which is continuing to affect the supply chain today. As the lead time for receiving building materials elongates, the price of development goes up. This leads to higher prices paid by renters and homeowners. There are also several development deals that have been cancelled because developers just can’t get the math to work with our current economic environment.

Where Is the Cheapest Place to Rent in Boston?

The most affordable places to rent an apartment in Boston are neighborhoods located on the city’s border or in the suburbs. Out of the 35 neighborhoods closest to Boston, Malden is the most affordable place to rent an apartment with an average rent price of $2,186. The following table breaks out the top 10 cheapest places to rent an apartment in Greater Boston.

| Town Neighborhood | Studio | Bedroom 1 | Bedroom 2 | Bedroom 3 | Bedroom 4 | Bedroom 5 | Avg. Rent |

| City Of Boston | $1,867 | $2,202 | $2,707 | $3,214 | $3,906 | $4,777 | $2,708 |

| MALDEN | $1,479 | $1,680 | $2,111 | $2,505 | $3,155 | $3,500 | $2,186 |

| BOSTON – WEST ROXBURY | $1,550 | $1,934 | $2,473 | $2,395 | $2,675 | $5,750 | $2,205 |

| QUINCY | $1,746 | $1,893 | $2,208 | $2,240 | $3,000 | $1,195 | $2,217 |

| WALTHAM | $1,575 | $1,766 | $2,307 | $2,595 | $3,071 | $4,025 | $2,263 |

| REVERE | $2,125 | $1,828 | $2,124 | $2,569 | $2,800 | $3,400 | $2,289 |

| CHELSEA | $1,844 | $1,852 | $2,236 | $2,547 | $3,000 | $2,800 | $2,296 |

| BOSTON – ROSLINDALE | $1,500 | $1,787 | $2,453 | $2,841 | $3,120 | $2,340 | |

| BOSTON – JAMAICA PLAIN | $1,437 | $1,882 | $2,405 | $2,989 | $3,511 | $4,256 | $2,445 |

| WATERTOWN | $1,796 | $1,971 | $2,309 | $2,684 | $3,464 | $3,499 | $2,445 |

| BOSTON – EAST BOSTON | $1,814 | $1,937 | $2,436 | $2,844 | $3,217 | $3,885 | $2,450 |

Where Are the Most Expensive Places to Rent in Boston?

The most expensive places to rent an apartment in Boston are mostly the neighborhoods close to Boston’s city center. Downtown Boston ($3,687), the South End ($3,652), and the North End ($3,441) are the 3 most expensive areas in terms of rent prices. Two of Boston’s best suburbs, Cambridge and Brookline, did make it on the list of top 10 most expensive neighborhoods to rent in Boston with average rent prices of $3,142 and $3,051 respectively.

| Town Neighborhood | Studio | Bedroom 1 | Bedroom 2 | Bedroom 3 | Bedroom 4 | Bedroom 5 | Avg. Rent |

| City Of Boston | $1,867 | $2,202 | $2,707 | $3,214 | $3,906 | $4,777 | $2,708 |

| BOSTON – DOWNTOWN | $1,893 | $2,456 | $3,484 | $4,350 | $6,250 | $3,687 | |

| BOSTON – SOUTH END | $1,999 | $2,612 | $3,391 | $4,277 | $5,983 | $6,475 | $3,652 |

| BOSTON – NORTH END | $2,069 | $2,410 | $2,984 | $4,124 | $5,618 | $3,441 | |

| BOSTON – NORTHEASTERN/SYMPHONY | $1,970 | $2,647 | $3,182 | $4,026 | $5,224 | $6,719 | $3,410 |

| BOSTON – FENWAY/KENMORE | $1,939 | $2,419 | $3,111 | $3,903 | $5,132 | $5,980 | $3,301 |

| BOSTON – BACK BAY | $2,063 | $2,649 | $3,571 | $4,865 | $13,500 | $3,287 | |

| BOSTON – SOUTH BOSTON | $1,787 | $2,453 | $2,965 | $3,801 | $4,906 | $6,560 | $3,182 |

| CAMBRIDGE | $2,122 | $2,442 | $2,945 | $3,642 | $4,557 | $5,871 | $3,142 |

Conclusion

We are dealing with the challenges of a poorly designed (or non-existent) national energy and fiscal policies that has led to runaway inflation, soaring costs of construction, and low overall permitting of projects compared to overall demand. The prospects of apartment rentals in Boston getting cheaper anytime sooner is not likely. While we do expect some demand destruction to occur because of poor economic conditions, we do believe that our housing market will remain strong because we simply do not produce enough quality housing.

The only way we can truly tackle bringing down costs of rents is to massively increase supply and that is going to take a lot of people to stop saying “Not in my back yard” to “Yes in my back yard.” We are going to have to put our differences aside and work on building more inventory so the consumer has more choices which ultimately drives down costs. The concept of waiting for recessions to drive down rents due to less demand is not a feasible nor viable long term solution. There are no easy answers or solutions. We are going to have to make choices that benefit the greater good – and that clear choice is through incentivizing and streamlining development so that we can add supply.

Demetrios Salpoglou

Published July 14, 2022

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.