1031 Exchanges, Delaware Statutory Trusts (DSTs) and Opportunity Zones

After years of enjoying ownership, it’s not uncommon for real estate investors to feel trapped in their investments because of the high capital gains and other taxes they’d owe if they were to sell. Despite wanting to retire from the day-to-day obligations, even if just partially, the idea of losing a large sum of the appreciated value to taxes from the sale is an unacceptable alternative. So, instead, their plan is often to simply hold their property(s) until they earn a step up of tax-basis at their deaths. In the meantime, as those properties age and require more maintenance and upkeep, it’s not uncommon that net income is reduced as owners increasingly defer to 3rd parties for handling the ever-present responsibilities and maintenance. In this blog, we will discuss two tax strategies that could potentially help defer some or all of your taxes when you sell.

The first approach involves using a 1031 Exchange into what is called a Delaware Statutory Trust (DST).

The 1031 Exchange

Most real estate investors have some experience with the 1031 Exchange. 1031 exchanges are commonly used when an investor sells existing, appreciated investment property in exchange for other investment property. 1031s have been around since the 1920s and were formalized in 1954 via Section 1031 of the IRS Code and have been legislatively refined over the years since.

1031s permit sellers to defer the taxable consequences of the sale as long as they exchange it for qualifying property, assuming the exchange process is followed exactly to avoid triggering a taxable event. Before any property is sold, the seller needs to hire a Qualified Intermediary (QI) as well as consult with their own tax counsel. When the sale transpires, the QI receives the proceeds (the exchanger can’t take constructive receipt) and holds them aside for the 1031 exchange. The 45-day identification deadline starts when you close on the property. In the 45- day period you must identify your prospective replacement property (or properties) desired for purchase. You have another 135 days (180 in total) after the 45-day period ends to complete the purchase. When that time arrives, the QI provides funds from the original sale for the acquisition and the 1031 is completed.

Replacement Property Options using DSTs

Most real estate professionals and investors generally understand that 1031s are great for those who want to remain in the business of active real estate or continue turning-over investment property.

But there is also a presumption that 1031s are of limited utility for those who want to retire from some (or all) of those obligations. After all, what would be the point of swapping one actively managed property for another, just to be stuck with the same operational headaches in a different, aging structure? Hence, the phrase “swap until you drop”, often associated with 1031s, commonly presumes the 1031 begins and ends with active rental property ownership and a step-up of basis at death.

Unbeknownst to many of them is Revenue Ruling 2004-86, which ruled in 2004 that Delaware Statutory Trusts qualify as replacement property for 1031 Exchanges. A DST buyer is investing in fractional and passive ownership of a professionally managed, turnkey real estate operation that conforms to rules that qualify it for 1031s.

Those who execute a 1031 exchange in conjunction with a DST not only defer the taxes associated with the sale, they also end the emergency calls for clogged toilets and broken HVAC systems. There is also no more budgeting for new boilers, roofs, or other major repairs. No more months spent chasing contractors to complete lingering projects. Those wanting to retire from these ownership obligations can defer those hassles to the sponsors, who in many cases are in the position to gain the scale efficiencies of institutional pricing not only on the properties, but also with financing, contractors, and property management.

Of course, no investment is perfect. DSTs have risk, pros and cons like any other investment. Those include each having unique business risks and a need for quality due diligence, to illiquidity. We can thoroughly discuss all the pros and cons associated with DSTs if this is of interest to you. You also must be an Accredited Investor (SEC Accredited Investor Definition) to invest in DST investments.

What if I sold a property already and was unaware of a 1031 exchange? Are there any other capital gain tax strategies available to use?

The Opportunity Zone Program, enacted as part of the Tax Cuts and Jobs Act of late 2017, has great potential to create jobs and spur economic growth while creating a potentially powerful tax strategy for investors. The Opportunity Zone Program is designed to attract long-term investments in designated urban and rural areas throughout the United States.

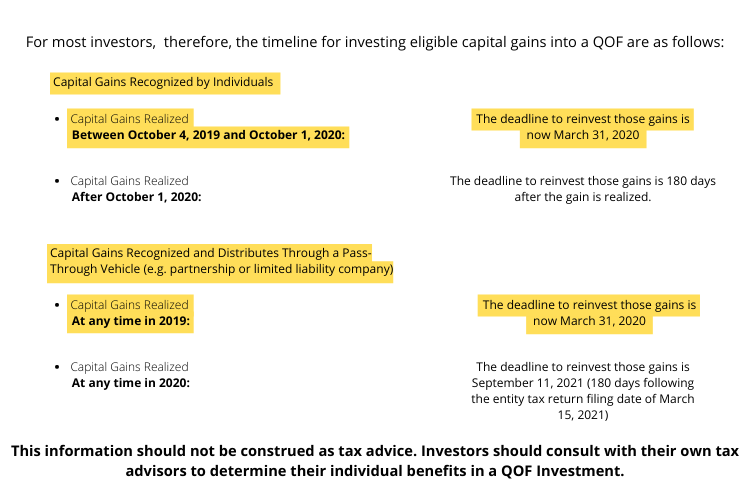

Investors have the opportunity to defer, reduce and ultimately eliminate capital gains if all the IRS criteria is met. You have 180 days to reinvest your gains into a Qualified Opportunity Zone Fund (QOF) (see the below chart for the latest IRS extension to the deadlines). Recently the IRS granted extensions to investors due to the COVID pandemic and certain investors can still defer gains as far back as 2019. A capital gain can be from a sale of real estate, a business, stock/bonds/mutual funds, cryptocurrencies, etc. QOFs allow investors to unlock unproductive assets and deploy this fresh pool of capital back into designated Qualified Opportunity Zones via a QOF, potentially creating jobs and spurring economic growth. You must be an Accredited Investor for these types of investments as well.

Education is power and we really want people to know what options are available to them. These strategies might not work for everyone but knowing that they are available is helpful. The IRS has given us two viable options to help defer some to all taxes depending on the strategy. Please feel free to reach out to learn more on both strategies and see if these are potential strategies that you can use.

Sean D. Whalen, CFP®, MSF

Published March 11, 2021