***UPDATED*** This market report has been updated, check out our 2023 Boston Real Estate Sales Market Report!

Boston’s real estate market has been one of the nation’s storylines over the past decade. The metro area has seen the housing market explode as the limited supply of real estate inventory just hasn’t been able to keep pace with growing demand. Now, Massachusetts holds the 5th highest median sale price among all 50 states, and Boston is not far behind San Francisco in terms of real estate prices.

Many predicted that the red hot Boston real estate market would cool off in 2022 amidst record inflation, rising interest rates, and a recession looming. Half way through the year, it looks like those predictions may be turning into reality. Real estate sales have dipped slightly compared to the beginning of the year and inventory is up considerably from last year. However, Boston real estate prices are still rising thus far in 2022, albeit at a slower rate than last year.

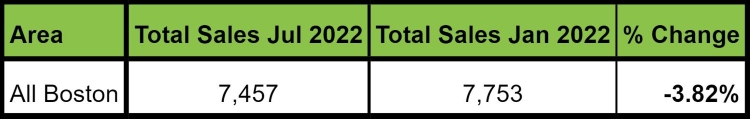

Boston Real Estate Sales Dip By -3.82% Through First Half Of 2022

Total 1-year sales of real estate properties have dropped by -3.82% in Boston over the first six months of the year. As of July 1, 2022, there were 7,457 properties closed in Boston over the previous 365 days. That figure stood at 7,753 on January 1, 2022, indicating that real estate demand has been curbed as interest rates have risen this year.

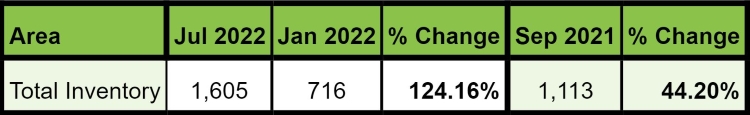

Supply of Homes For Sale Is Rising In Boston

If you look at the total supply of real estate inventory in Boston through the first half of the year, you’ll see more evidence that demand is waning. The total number of listings for sale in Boston was 1,605 at the beginning of July, which is up +44.20% since September 2021 when only 1,113 were available. For the first time since 2018t, the number of listings for sale has increased year-over-year in Greater Boston. If you combine rising inventory with a decrease in sales, you’ll be looking at the early signs of a potential price correction in the Boston housing market. Thus far, that has not been the case as prices are still on the rise in Boston.

Despite the increase in for-sale inventory, total supply of properties is still scarce in Boston. This has been the main driver of median home price growth over the past decade. Combine these high prices with rising interest rates, now even more would-be-buyers are being pushed towards renting in 2022. This trend is contributing to the record high occupancy rate the Boston rental market is experiencing this year.

Boston Median Sale Price Growth Slowing in 2022

The 1-year median sale price for single family homes in Boston is $810,057 as of July 1, 2022. That figure is up +3.66% compared to January 1, 2022, and up 7.29% since September 2021. Similarly, the 1-year median price for Boston condos ($718,814) is up 2.69% since the beginning of the year and up +5.71% since September 2, 2021.

This shows that median price growth has decelerated by roughly 50% thus far in 2022 compared to the final quarter of 2021.

Boston Real Estate Market Forecast 2022

It’s clear from the data that Boston’s real estate market is showing early signs of cooling. This should come as no surprise considering the economic uncertainty we’re facing. Poor fiscal and energy policies have resounding consequences on housing markets, some directly and some indirectly. Here are 5 trends to look out for that will have an impact on real estate prices over the next year.

1. Rising Interest Rates Curbing Housing Demand

Inflation is showing little signs of slowing down according to the most recent CPI updates from the US Bureau of Labor Statistics. The consumer price index is up 9.1% since last June and the Fed is eyeing another rate hike to try to get it under control. Some are saying it might be the biggest rate increase in decades. As the Fed continues to raise interest rates, it will continue to price many buyers out of the real estate market in Boston, which will counteract price growth. Inflation’s effects on the housing market is not limited to just interest rates.

2. The Trickle Down Effect Of Poor Energy Policy

The price of diesel fuel holds heavy implications for housing markets. The year-over-year change in the price of diesel is +84.9% as of May 2022. As a result, the price of construction materials are rising by significantly larger margins than the +9.1% increase on consumer products. When diesel prices rise, so does the cost of shipping large heavy construction materials. With the extra cost of shipping tacked on to the final price tag, it increases the costs of building and maintaining properties for developers and property owners. Development companies are now paying significantly more to build new housing in Boston, which will in turn work to push prices even higher for new construction in the short-run.

3. Labor Shortages in Massachusetts

Another factor impacting development companies is the labor shortage that has been prevalent since COVID. Massachusetts’ labor participation rate of 66% is down by a percentage point compared to 2019 levels and is struggling to recover from when it plummeted to 60.5% in April of 2020. When developers cannot find laborers to work, new construction projects stall. The developer carries the costs of those delays in the form of loan payments and delayed cash flow, which eventually drives up the cost of new construction housing units when they hit the market. Labor shortages also slow the addition of new housing units to the city, which is desperately needed in Boston where housing inventory shortages have driven up real estate prices in recent years. This trend will continue to limit supply and push real estate prices high in the short term, as long as housing demand holds steady. In the long run, housing demand seems less certain.

4. Recession and its Effects On Housing Demand

Aside from inflation, the biggest economic concern on everyone’s mind is the impending recession. Some would argue that we’ve already entered into the recession phase, which is an inevitable consequence of inflation and rising interest rates. If we’re seeing demand for Boston real estate dropping because of rising interest rates thus far in 2022, imagine the demand destruction that would occur if we see massive corporate layoffs and downsizing in Boston’s tech sector. We’re still in the early stages of the economic downturn, so it’s difficult to forecast if and by how much real estate prices may drop in the long run.

5. Supply Chain Disruption and Construction Costs

Since the onset of COVID-19, we’ve seen unprecedented supply chain disruptions across all types of industries. When harsh lockdowns closed ports in China and across the world, the global distribution of goods was frozen and cargo ships were backed up in nearly all major ports. This has impacted the construction industry significantly as shipping containers are still scarce and construction materials take up a large amount of container space.

When builders can’t get the materials they need to complete projects, it delays development of new housing. That will limit the supply of homes for sale, which pushes real estate prices upwards. It also adds to the costs of developers, which in turn gets passed down to the buyer.

Boston Real Estate Sales Market Forecast 2022-2023

We expect real estate price growth will continue to decelerate in Boston this quarter before leveling off in Q4. We do expect prices to dip next year based on current economic factors. To what extent prices fall next year remains unclear at the moment, as there are numerous market forces exerting pressure on prices. Inflation is at its highest point in decades, and a recession looks imminent if not already here.

Boston’s median sale price will likely peak around $830,000 for single family homes and close to $730,000 for condos towards the end of September. In 2023, it’s quite possible to see median prices to drop by 5-10% as a result of: higher interest rates, extended effects of an incoherent energy policy, global security uncertainty and lower demand. Median prices for condos will likely drop by a higher margin compared to single family homes. This is due to the fact that the inventory of single family homes is significantly lower than the supply of condos in the Boston housing market. We will continue to cover these real estate market trends as they develop.

Demetrios Salpoglou

Published August 3, 2022

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.