Boston’s apartment rental market has experienced unprecedented price increases over the past two years. The average rent price for a Boston apartment is up an astounding +20.56% since April 2022 amid a resurgence in apartment demand and a shortage of available housing units. The cost of renting an apartment has never been higher in Beantown, leaving many to wonder when relief will arrive for renters in Boston. Our poor national energy policy with soaring gas prices helped spark inflation that sent nearly every aspect of construction and renovation pricing far higher. Labor prices soared and here we are with record-low development of apartments in Boston.

Several other socio-economic factors are causing uncertainty as we look towards the future of the local rental market. The ever-threatening politics of whispering future rent control measures has developers placing their capital in other high-growth cities around the country where they believe they can recapture their risk capital in this inflationary environment.

Boston is a unique market.

There is always demand for Greater Boston housing but onerously high affordability requirements in the development deals themselves cause builders to pause or walk away from approved plans because the deals simply do not pencil. Asking for even 15% of a builder's unit count in a development deal to be affordable makes nearly almost every construction fall flat. Interest rates are also high and the cost of borrowing is another hurdle in a simple math equation that is loaded with risk. The great irony of pushing developers to add more affordable units into their mix causes less development which in a twisted way halts production and keeps prices high. That pesky supply and demand thing never fails to be extremely accurate in how it dictates pricing.

It’s been clearly evident that our policies of creating supply are not working in this economic environment; but is there a possibility that rent could go down in Boston in 2024? What is the catalyst or tipping point that causes people to move out of Boston?

While it’s impossible to predict with absolute certainty what will happen to Boston’s rent prices in the future, we can analyze current market conditions and forecast what will happen to rent prices in 2024 and beyond. In this article, we will take a closer look at all of the factors that are influencing Boston’s rent price and tackle the question everyone wants answered.

Factors Influencing Rent Prices in Boston

Rent prices, and prices in general for that matter, are mostly governed by real-time availability rate (RTAR) and real-time vacancy rate (RTVR). You simply can’t expect rental prices to go down when there are always scores of new renters wanting to move into Boston. When supply decreases and/or demand increases, prices go up and this has been documented across the world for hundreds of years. When supply increases and/or demand decreases, prices go down—again this is nothing earth shattering or ground breaking news. This is the most basic and important economic principle when it comes to prices. That being said, let’s take a look at a few factors influencing the supply and demand of apartments in Boston.

Boston’s Housing Supply Problem

The biggest factor contributing to Boston’s soaring rent prices over the past decade is the lack of housing supply in the metro area. Boston is a small, densely populated city. It’s also one of the oldest cities, established way back in 1630. It’s been developed and re-developed several times over, leaving very little room for development of much-needed new housing units. Whatever is left of large undeveloped or underdeveloped land is owned by a few universities that have a knack for sitting on it and waiting for economic conditions to be really bad before strategically moving forward with projects. Economic timing is everything, and universities often think in twenty to fifty-year increments regarding their master campus plans. It is far easier to sit on land when universities do not pay those pesky things called various state and local taxes that the rest of the business community floats.

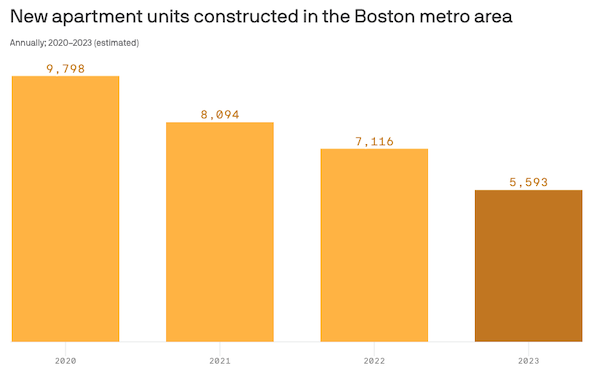

Boston has had several administrations outline the priority for housing but we never seem to get building more units than our population growth. Our housing initiatives made progress during the late 2010s until COVID-19 derailed much of the new development progress. Since then, new housing permits issued and new construction projects completed have dropped significantly, effectively worsening the housing supply problem in Boston.

Since the pandemic, rising interest rates, huge increases in construction costs, supply-chain issues and slow permitting by City Hall have all been contributors to Boston’s housing shortage. Most developers are sitting on their hands waiting for interest rates to come down at least two or three points before they see any new development projects profitable in Boston, causing many to throw in the towel and invest elsewhere. This is a critical obstacle in the way of boosting Boston’s housing supply, and one City Hall will have to remedy if we are to combat soaring rent prices. Perhaps a two year removal of affordability requirements could help developers get going in this tough building environment. Another solution would be to allow developers to match affordability unit count requirements pegged to interest rates. The higher the interest rate the lower the affordability requirements in the deal. That way everyone can benefit from more housing being delivered and it could satisfy a wide range of disparate interests and vocal groups. It is simply unfair to put all the burden of economic risk on the developer which ends up keeping our rental and sales pricing higher for everyone. We need supply and we have to come up with serious and new solutions.

Demand For Housing in Boston

Prior to the pandemic, Boston’s metro population was steadily increasing since 2000. That trend strained the limited housing supply in Boston, which was the primary reason rent prices grew so much over that period. When COVID-19 arrived, we saw a drastic shift in housing demand.

When campuses shut down and offices went remote, we saw a sharp drop in apartment demand city-wide. This caused rent prices to drop briefly during the second half of 2020 and the first half of 2021. Once campuses opened back up and some professionals re-entered their office spaces, demand for rental units was restored and price growth accelerated from there.

Over the last 20 years, we also saw a shift in housing demand alongside demographics. During that time span, Boston emerged as one of the leading markets for venture capital funding, attracting tens of thousands of jobs in the medical and biotech spaces. With all these new white-collar jobs came a demand for high-end luxury housing. Ironically, because we have so many safety and green features that are required in our building processes – luxury units often pencil quicker than workforce housing because the higher rents help pay back the investment in the property over a shorter period of time. Our new construction practices have never been better; but there is always a cost for higher quality construction. Math is math.

Current State of Boston’s Apartment Rental Market

Boston’s rental market appears to be returning to the historical trends that were prevalent prior to the pandemic. After two years of extremely low apartment supply, the current real-time availability rate (RTAR) for Boston apartments is 5.08%, up +16.78% compared to a year ago and very close to its pre-pandemic level in early April 2019. We are starting to see a return to 2019 levels of availability but the prices are higher. There have been a record amount of apartment renters re-signing their leases for the last two years – but time moves on. Most students and young professionals tend to move out of apartments after two or three years so it is fair to expect a higher turn over in 2024. So while a lot of people grabbed great apartments right after the pandemic ended; life, school and work requirements often make renters eventually move to more life appropriate choices. You can’t hang onto that great apartment forever if you graduated college and your new job just called you in Texas. We will most likely also see higher turn over in 2025 but that is for a different article.

As a result of the supply shortage easing, we’ve seen price growth decelerate over the first few months of 2024. According to our latest Boston apartment data, rent prices are up +7.19% over the past 12 months and up +20.56% compared to two years ago. So that leads us to the question we’ve all been waiting for. Are rent prices going down in Boston?

Are Rent Prices Going Down in Boston?

At this moment, rent prices are not going down in Boston. They are still trending upward albeit at a slower pace than last year. Boston’s average rent price is up +0.96% compared to 3 months ago, and up +3.81% compared to 6 months ago.

A closer look at the historical average rent price for each apartment size shows rent prices leveling off during Q3 of 2023 before accelerating again through the first quarter of 2024. Prices for studio apartments and 5 bedroom apartments have actually dropped slightly over the last couple of weeks in Boston. Rent prices for other apartment sizes have flattened slightly during that time span, providing evidence that rent price growth may be leveling off again. Could this be the first sign that rent prices will drop in Boston? What is the biggest driver of rents going down?

We do not believe that rent prices in Boston will be going down for the 9/1/24 – 8/31/25 leasing cycle. There are simply not enough job layoffs happening. Our Bostonpads real time leasing platform is not seeing any significant lease breaks or sublets indicating a derailment of economic activity. Historically when a recession would hit we would see a vast amount of people asking for help subletting their unit or finding a replacement to work through their existing lease. Thankfully our job market and economy are vibrant as well as diversified so we are not seeing huge points of job failure. Wages continue to rise so people can afford higher rent. Universities keep raising their tuition to nosebleed levels but it is still not halting demand at quality institutions.

We are now entering the peak season for apartment demand, which is historically when rent prices are on the rise in Boston. While the RTAR has loosened up considerably compared to a year ago, it has not hit a level that would suggest that demand has diminished significantly enough to push prices downward. We will likely see rent prices continue to climb as we near the 9/1 leasing date and then see them level off again through Q4 2024 as seasonal demand wanes. Should interest rates curiously come down in late summer or early fall that could also spark the stock market to run and have an impact on people feeling more wealthy and take the plunge for higher rent pricing.

Beyond this year, we will have to keep a close eye on the local economy, population trends and new construction data to determine if rent prices will go down. If westart to see a population decrease in Boston, it could cause rent prices to drop. If we see a big influx of new housing units as a result of interest rates dropping, itcould ease price growth in 2026 but remember it often takes two years to get larger developments built and ready for lease up. If we experience an sharp economic downturn resulting in a mass wave of layoffs, we should see demand diminish and rent prices reduced much faster. Housing is a complicated issue in Boston and there are not easy solutions.

One of the best things to do to find a great apartment is to work with a company that can show you the most units possible so you feel empowered that you made the best leasing decision available. Working with companies that utilize the best technologies that can send you an instant text or email on a price reduced unit and or an underpriced apartment that just came to market can often help you score a better apartment than your peers. While Boston rent prices will most likely not come down in price in 2024; that doesn’t mean you can’t find a great deal. Work with market leaders and utilize their technology and trained real estate professionals to strategize and develop an apartment plan of success.

As always, we will continue to monitor these housing market trends as they develop here on BostonPads.com.

Demetrios Salpoglou

Published April 29, 2024

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.