***UPDATED*** This market report has been updated, check out our 2022 Medford Apartment Rental Market Report!

Medford’s apartment rental market has been able to avoid seeing some of the more severe effects of COVID-19. Vacancy rates aren’t up nearly as much in Medford when compared to nearby Somerville, Cambridge and Boston, but don’t let that fool you. The market is far from ideal in Medford, and vacancies for Medford apartments are up significantly year over year.

See Also: 2021 Greater Boston Apartment Rental Market Report

Apartment Vacancy Rates in Medford, MA

Medford’s real time vacancy rate (RTVR) is currently sitting at 3.57%, up +218.75% since October 2019. That figure may have seemed unthinkable a year ago when Medford’s vacancy rate was 1.12%, but as we’ve seen reality can shift quickly during a pandemic. Even today that 218.75% is among the lowest spikes in inventory compared to the City of Boston and even the outer suburbs.

Overall, the increase in inventory in Medford has been minimal compared to neighboring areas:

| Neighborhood | 2020 Vacancy Rate | 2019 Vacancy Rate | % Change |

|---|---|---|---|

| All Areas | 7.18% | 1.63% | +439.85% |

| City of Boston | 8.38% | 1.60% | +525.37% |

| Outside Boston | 5.47% | 1.74% | +314.39% |

| Medford | 3.57% | 1.63% | +218.75% |

| Malden | 8.93% | 1.62% | +551.82% |

| Brookline | 8.50% | 1.03% | +823.91% |

| Cambridge | 7.90% | 1.35% | +586.96% |

| Somerville | 4.85% | 1.99% | +243.97% |

| Watertown | 3.28% | 0.70% | +465.52% |

| Newton | 3.16% | 2.52% | +27.42% |

| Arlington | 3.16% | 0.79% | +401.59% |

This chart shows that apartments in Medford have had the lowest increase in Vacancy Rate of all areas with the exception of Newton. The suburbs as a whole had an average net increase in inventory +314%, which is significantly higher than Medford’s increase of +218.75%. It would have been hard to believe we’d be celebrating a 2.5x increase in vacancy rate in 2019 but here we are.

The City of Boston had a significantly higher increase in vacancy rate at +525% compared to the suburbs (+314%), and now the overall inventory in the city (8.38%) is higher than that of the suburbs (5.47%) which is not typically the case. In fact, it has always been a safe mathematical assumption to see the outer ring of Greater Boston higher apartment vacancy rates. This sound financial theory has always been baked into reflecting neighborhood cap rates accordingly, and line itemed as vacancy risk to property investors pro-forma. The pandemic certainly changed a lot of investor sentiment in where capital should be deployed for positive returns.

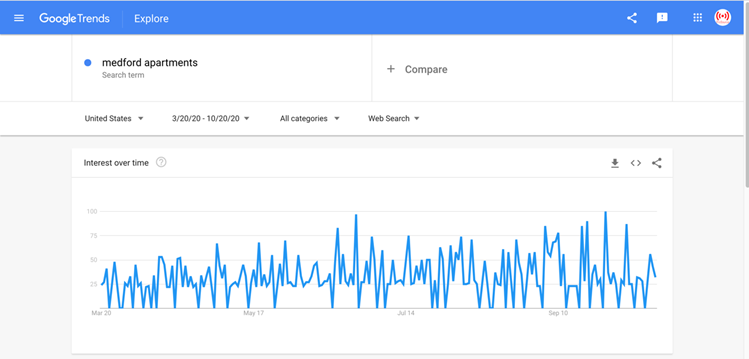

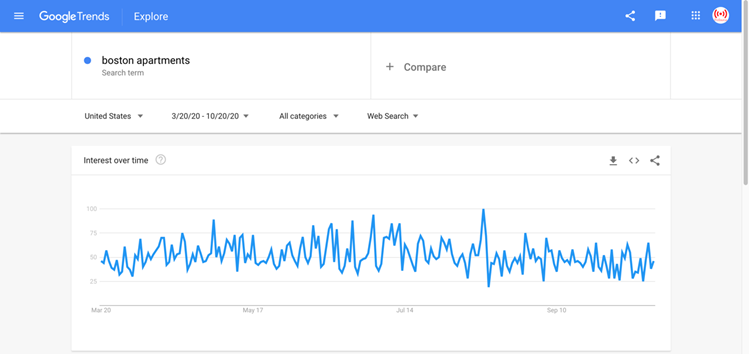

Trends in Google search data supports what the data suggests: demand for housing in the suburbs is increasing while areas with denser population is decreasing. Areas that are the most densely populated are seeing the highest spikes in vacancies. Medford provides renters an option just minutes from the city that has a wider population dispersion, making it ideal for commuters. Historically, Medford has always maintained lower overall rents than apartments in Cambridge or Somerville and that has helped with tenants deciding to stay put in their places rather than decide to leave for less human dense footprints. In some respects it’s location and price has provided it some combined characteristics that has allowed it to weather the pandemic storm far better than most nearby Greater Boston areas.

There are a few pockets of RTVR in Medford that are higher than other neighborhoods. Different theories have been floated around why there is disparate real time vacancy rate numbers. We have concluded that based on data, looking at current inventory and discussions with landlords in those areas that it is a mixture of condition of some properties and influence and impact of the Tufts marketplace with students having modified remote learning.

| Neighborhood | Realtime Availability Rate | Realtime Vacancy Rate |

|---|---|---|

| Magoun Square | 6.96% | 6.09% |

| Medford Square | 3.54% | 3.07% |

| Tufts | 6.00% | 3.58% |

| Wellington | 4.01% | 3.28% |

Average Rent Prices in Medford MA

Medford still is in middle of the pack in terms of average rent prices in the Northern suburbs. It is less expensive to rent in Medford compared to Cambridge, Somerville, and Brookline but more expensive than Malden, Revere, and Chelsea. Rent prices in Medford are similar to that of Watertown.

| Neighborhood | Studio Avg. Rent | 1 Bedroom Avg. Rent | 2 Bedroom Avg. Rent | 3 Bedroom Avg. Rent | 4 Bedroom Avg. Rent | 5 Bedroom Avg. Rent |

|---|---|---|---|---|---|---|

| Medford | $1,869 | $1,555 | $2,165 | $2,718 | $3,364 | $3,952 |

| Watertown | $1,573 | $2,001 | $2,241 | $2,465 | $2,868 | $4,300 |

| Malden | $1,428 | $1,659 | $2,060 | $2,385 | $2,669 | $3,299 |

| Brookline | $1,804 | $2,267 | $2,747 | $3,388 | $4,085 | $5,304 |

| Cambridge | $1,847 | $2,280 | $2,799 | $3,373 | $4,303 | $5,311 |

| Somerville | $1,862 | $2,021 | $2,460 | $2,930 | $3,762 | $4,582 |

| Revere | $1,680 | $1,904 | $2,225 | $2,477 | $2,760 | $3,533 |

| Chelsea | $1,700 | $1,750 | $1,950 | $2,546 | $3,633 | $1,975 |

Renters can find great deals on 1 bedroom apartments in Medford, while 2 and 3 bedroom apartments typically are average for the area. Increases in rent prices have been significantly less in Medford compared to some of the other area of Greater Boston. While rent prices are down in Cambridge, Somerville, and Brookline, rent prices are remaining steady if not slightly increasing in Medford and Malden. These increases could be more cyclical in nature based newer renovated properties that are coming available to the marketplace.

This data suggests that Medford’s landlords are perhaps confident they will be able to get a good rental price with Tufts students and many others often renting far ahead of their move-in date. However, we are heading towards winter. Price reductions can happen quite quickly, often based on property owners gut instincts, which often change in concert with other landlords. Many landlords watch what other landlords are doing and make adjustments based on their competition in the free marketplace. If many units go unrented, it could lead to real price drop in Medford over the course of November and December, but that remains to be seen. We’ll be monitoring these trends closely.

Demetrios Salpoglou

Published October 26, 2020

Demetrios has pulled together the largest apartment leasing team in the Greater Boston Area and is responsible for procuring more apartment rentals than anyone in New England – with over 130k people finding their housing through his services. Demetrios is an avid real estate developer, peak performance trainer, educator, guest lecturer and motivational speaker.